What to Know:

- Taiwan is auditing $BTC exposure and assessing a reserve strategy, with a formal report due by end-2025. This marks a credible institutional tailwind for Bitcoin.

- Sovereign-level interest strengthens the ‘digital gold’ case and can add marginal demand, supportive for $BTC price and $BTC-native infrastructure.

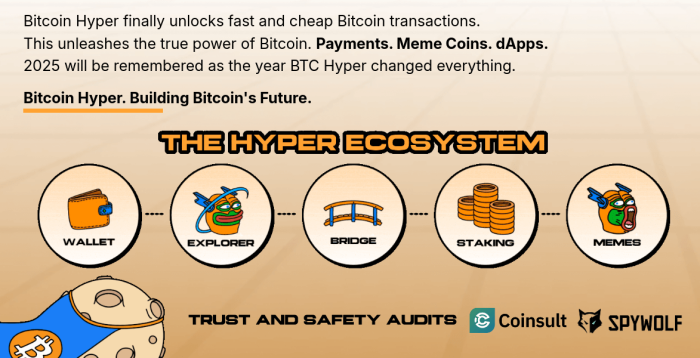

- Bitcoin Hyper targets speed and programmability for $BTC via an SVM-based Layer-2, aiming to unlock faster payments, DeFi, and dApps within Bitcoin’s ecosystem.

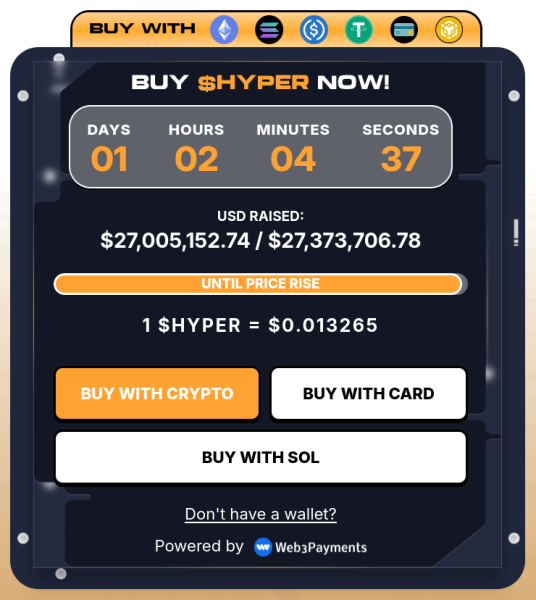

- $HYPER’s presale price is $0.013265; a potential high of $0.08625 in 2026 could mean a +550% ROI if devs successfully hit project milestones.

Taiwan plans to put Bitcoin on its policy map. Lawmakers have pushed for a full audit of the government’s $BTC exposure and a formal study into adding Bitcoin to national reserves.

Premier Cho Jung-tai pledged a detailed Taiwan reserve-strategy report by year-end 2025. That’s not a casual nod. It’s a signal that $BTC is graduating from ‘risk asset’ to potential sovereign-grade reserve. The motivation is simple enough: diversify a reserve stack still dominated by USD and add a liquid, hard-capped asset with global settlement.

This decision comes after Taiwanese legislator Ju Chun Ko had framed Bitcoin as a ‘digital gold’ hedge to USD concentration back in a May 9 session, signalling political cover for a serious allocation debate.

Today, Taiwan’s FX hoard sits in the hundreds of billions, totalling $602.94B (of which 90% is USD), as per the CBC. So, even a small allocation would be material on the margin. A proper audit also sweeps up seized coins held by agencies following legal cases — inventory that could seed a pilot treasury program instead of being dumped at auction.

This policy change could cause a domino effect. One credible government exploring $BTC reserves tightens the supply narrative and reinforces the ‘digital gold’ idea – particularly in an environment where ETFs have already absorbed a steady flow.

If the report lands on schedule and the door opens to a modest allocation, the market gets another demand vector. Projects building real utility around Bitcoin typically benefit first. That’s the plan for Bitcoin Hyper ($HYPER), a $BTC-centric Layer-2 aiming to turn store-of-value into a spend-and-build ecosystem.

Bitcoin Hyper Wants to Turn Bitcoin Into a High-Throughput DeFi Ecosystem

Bitcoin Hyper ($HYPER) is building a Layer-2 that uses the Solana Virtual Machine (SVM) for fast execution while anchoring finality to Bitcoin’s base layer. In plain English, this means: cheap, low-latency transactions and smart-contract capability without altering Bitcoin’s consensus.

Imagine Solana-style speed and programmability on top of Bitcoin’s security – a combination that’s been missing in $BTC-native ecosystems.

To make this happen, the project’s playbook includes a canonical bridge for wrapping $BTC for DeFi use on the Hyper side chain, then releasing the L1 $BTC back to your wallet on exit. Once the live net is up, this setup makes it possible to onboard tooling for payments, DeFi, and dApps.

Security is also a dev priority, especially for the project’s financing rounds.

External checks from Coinsult and SpyWolf have reviewed the $HYPER token contract and flagged no backdoors or mint functions, a non-negotiable baseline to ensure token scarcity and fair trading. That doesn’t guarantee crypto success, of course. But good security does reduce avoidable smart-contract risk at the token layer.

If Taiwan’s review lifts Bitcoin mindshare and on-chain activity, networks that make $BTC usable sit in the slipstream. That’s the lane $HYPER wants to own with its cheap payments, DeFi compatibility, and quick confirmations.

See Bitcoin Hyper’s ecosystem plans.

$HYPER Token’s Presale Is in Full Swing with $27M+ Raised

Bitcoin Hyper ($HYPER) is the utility crypto for the Hyper network. Now in presale, $HYPER has crossed $27M, with plans to set aside 75% of its funds to support project development, marketing, and a long-term treasury.

The token is priced at $0.013265 right now, though its fundamentals leave room for upside once liquidity and listings arrive in Q4 2025/Q1 2026. According to our $HYPER token forecast, the token has a potential high of $0.02595 in 2025 and $0.08625 in 2026 if listing and live mainnet milestones land as planned.

From the current presale price, those levels imply about +96% and +550% respectively — not the moonshot hype you’d see on Crypto Twitter, but grounded in real value and fundamentals.

Put simply, if utility ships and Bitcoin stays bid, this type of multiple isn’t fantasy.

The market context is certainly on Hyper’s side. Taiwan’s review timeline runs through 2025, overlapping with Bitcoin Hyper’s roadmap windows. A favorable government report won’t flip a switch on day one, yet it improves the macro narrative for $BTC-aligned infrastructure exactly when $HYPER aims to turn on throughput.

If a sliver of sovereign-level demand materializes, the liquidity tide can lift the $BTC-centric stack, extending to bridges, wallets, and L2s that make $BTC actually usable. That’s where a fast SVM execution layer tied to Bitcoin’s settlement could capture real volumes instead of pure speculation.

Join Bitcoin Hyper and get 43% APY.

This article is informational content, not financial advice. Crypto is volatile; research market momentum and sentiment and remember – presales don’t offer guarantees.

Authored by Aaron Walker, NewsBTC — https://www.newsbtc.com/news/taiwan-bitcoin-reserves-end-of-2025-bitcoin-hyper-layer2-to-rally/