Chartered Market Technician (CMT) Tony “The Bull” Severino argues that Bitcoin’s most dependable macro tell—the copper-to-gold ratio—has broken character at the very moment the market typically enters a parabolic phase, leaving the post-halving script in disarray and altcoins without their usual rotation.

Why The Copper/Gold Ratio Is Crucial For Bitcoin

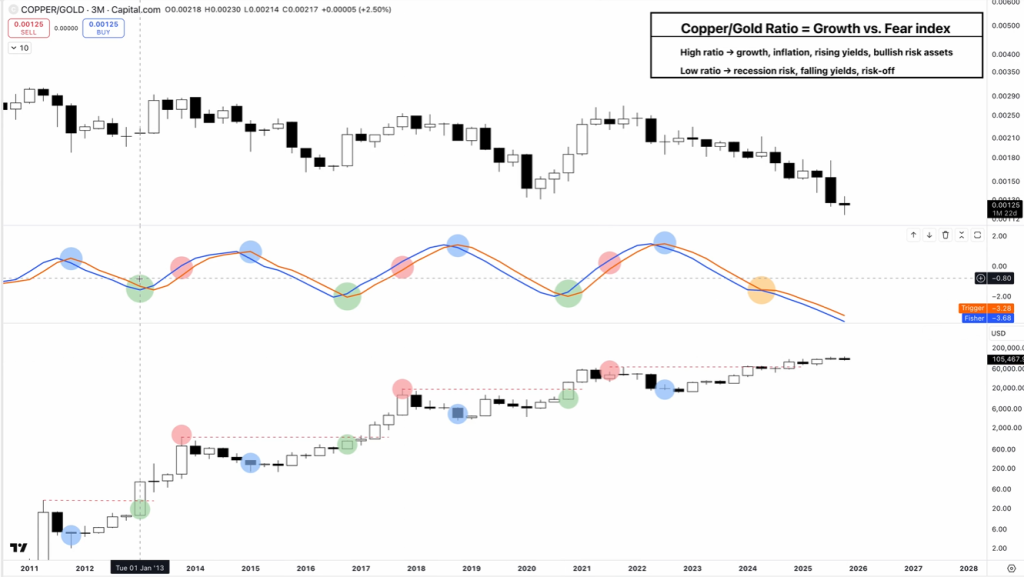

In a 16-minute video analysis published on November 10, Severino frames the copper/gold ratio as a “growth versus fear index,” where copper strength signals expansion, rising yields and appetite for risk, while gold outperformance maps to recession risk, falling yields and risk-off behavior.

“When gold is performing better than copper, it typically means economic slowdown [and] general recession fears,” he said, adding that copper’s industrial demand anchors the ratio to the business cycle. The punchline: the ratio’s cyclical turn that historically coincides with Bitcoin’s vertical phase simply never arrived. “They say the most dangerous thing to say in investing is that this time is different. Well, this time is different,” Severino said. “The business cycle based on the copper versus gold ratio did not turn back up.”

Severino contends that the four-year halving lore is at best incomplete and at worst misattributed. He overlays prior halving dates with a Fisher Transform signal on the copper/gold ratio and observes that the true inflection has historically been macro, not supply-driven. “I never really thought it was the halving,” he said. “The same halving date started a bull run in the Nasdaq […] the halving in Bitcoin would not really have any effect on tech stocks.” In his construction, the halving has coincided with, rather than caused, the ratio’s upswing and a risk-on impulse that typically propels Bitcoin beyond prior highs into a final, parabolic leg.

This cycle diverged. After briefly producing a “higher high” in the ratio—the first since roughly 2010—copper/gold failed to establish a higher low and instead printed “another lower low,” marking, in Severino’s words, the lowest reading in about 15 years on his chart—“since pretty much since the Great Recession.”

The Fisher Transform that had historically flipped up to confirm the risk-on window never delivered the full follow-through. “It was supposed to send Bitcoin into the final stage of its parabolic rally […] we didn’t go parabolic after going above all-time high. We’re just kind of meandering sideways.”

Is The Bitcoin Cycle Top In?

Timing-wise, that failure matters. Severino measures roughly a year between the ratio’s go-signal and Bitcoin’s cycle top in prior episodes. By that yardstick, “we really should have topped” already or, if anchored to the March breakout above the 2021 high, would at least be entering a risk-off window. But without the definitive risk-on impulse, the cycle landmarks blur. “Because we didn’t get the full risk on, I don’t know where the risk off signal is,” he said.

The implications extend to altcoins and Bitcoin dominance. Historically, the ratio’s green “risk-on” phase lined up with “alt season,” but this time the setup never materialized. “You normally get your alt season at these green points […] We didn’t get it here,” Severino said, noting Bitcoin dominance is holding key support on higher-timeframe views. He also highlights an “extremely strong negative correlation” between Bitcoin and the copper/gold ratio at present; in past cycles, correlation drifting toward zero tended to coincide with altseason. “None of the conditions for altcoin season seem to be here based on past economic signals,” he added.

Severino stops short of a deterministic call. The ratio’s trend structure is ambiguous—one failed breakout from a long downtrend does not make an uptrend—and the Fisher signal could still turn. But until it does, he argues, macro says caution.

“We’re still in the fear sort of side of this ratio. We need to still be defensive and we should be risk off. When this starts to turn back up, we can consider being bullish risk assets again.” That ambiguity, he suggests, is precisely why Bitcoin’s post-ATH drift has defied the well-worn four-year narrative: “It just didn’t do the same thing as it did in the past […] We are different. It is genuinely different this time.”

At press time, BTC traded at $104,486.