Bitcoin Magazine

Bitcoin Support Under Attack as Bears Look to Push Price Below $100,000

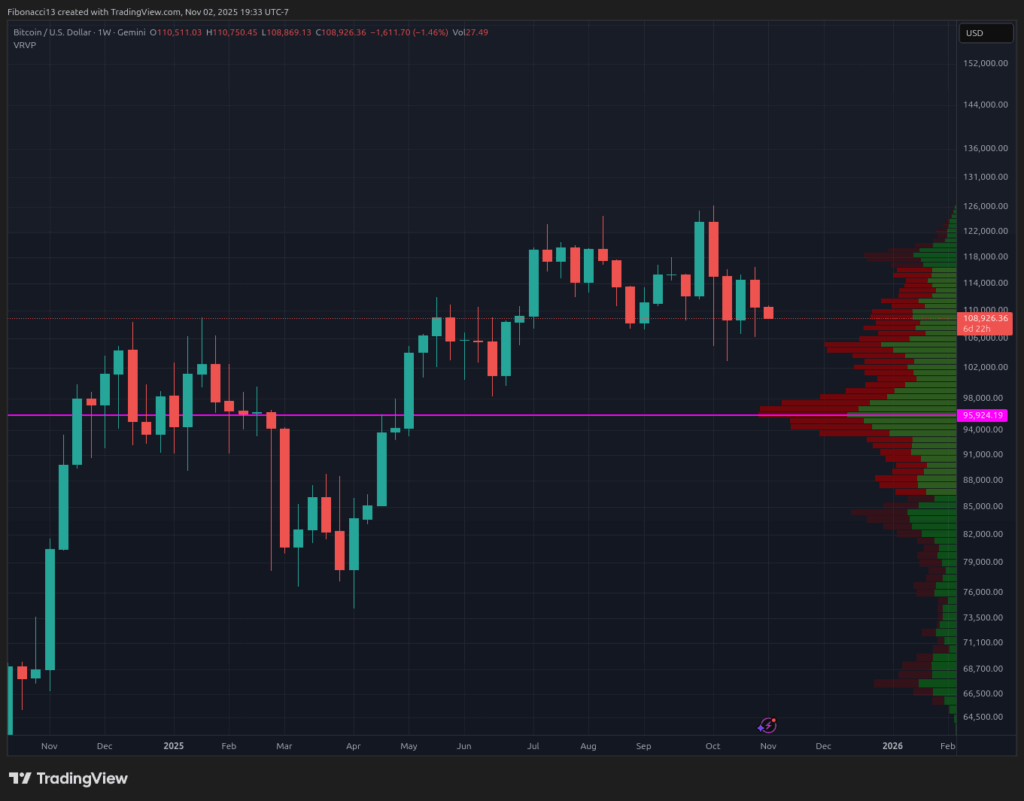

It was a very disappointing week for bitcoin price action last week. Monday saw a nice move up into resistance, but that momentum quickly faded as bitcoin retraced the bullish move to end up right back down at the lows by Thursday. The market was a mixed bag as the Federal Reserve’s 25 basis point cut was expected, but Chairman Powell put a damper on expectations going forward, stating that there were no plans to continue with another interest rate cut in December’s FOMC meeting, which the market had been expecting. Bitcoin closed the week out at $110,591, which wasn’t entirely bearish, but was not confidence-inspiring for the bulls either.

Key Support and Resistance Levels Now

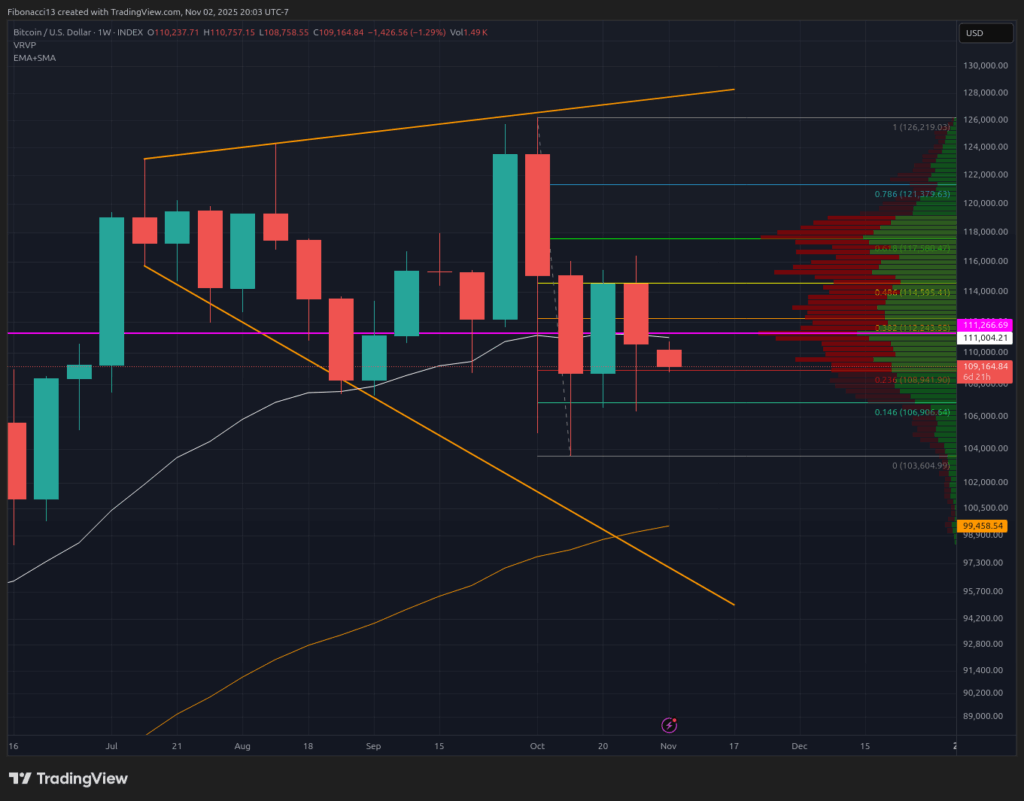

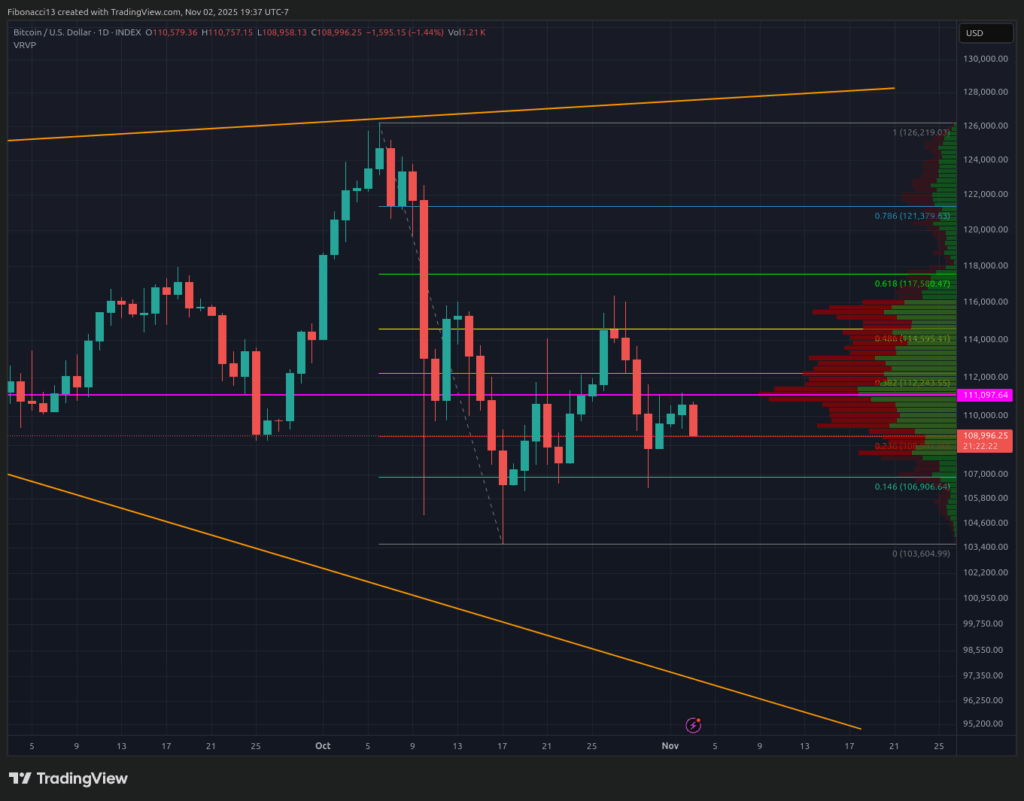

The $106,900 support level held again last week at the 0.146 Fibonacci Retracement, providing a nice bounce for the bulls on Thursday into the weekly close on Sunday. Bulls do not want this level to be tested again going forward, as it would be more likely to fail on the next test. Losing this level is very likely to lead to losing $100,000 and a test of long-term support at $96,000. We do have potential support at $104,000 before there, but this level has been tested twice already, so it would be a big ask for this level to hold as support once again.

The bearish price action last week has only created additional resistance levels for the bulls to overcome here. Price closed last week below the 21-EMA, which sits right around $111,000 entering this week. The volume profile is also showing us a point of control (POC) at $111,000 as well. If price manages to climb above $111,000, we will look to $114,600 as the next resistance level. Closing above $114,600 opens up $122,000 as the final hurdle to overcome for the bulls to take back control of the action.

Outlook For This Week

Bitcoin is likely to break support to the downside this week unless buyers can step up in a big way, with strong buying volume. Look for $106,900 support to be lost if the price starts closing below $108,000. $104,000 should provide a bounce below there, but the $96,000 support is likely to be tested if $104,000 doesn’t hold for long. Bulls will likely need some sort of macro catalyst this week to save themselves from lower prices, as the daily chart is looking very bearish heading into this week. As of Monday morning, it appears bitcoin is losing the $106,900 level and will test $104,000 or lower.

Market mood: Bearish – The bulls’ hopes were beaten back this week when the price failed to hold above the $115,500 resistance level. The onus is still on the bulls to take out some upper resistance levels to try to swing bias back in their favor.

The next few weeks

Bitcoin is likely to take a backseat to the Nasdaq price action going forward. It will be very difficult to sustain any kind of upward movement if the Nasdaq continues to correct lower over the coming weeks. So, bitcoin bulls will be hoping for the Nasdaq to resume its uptrend to help them out. Bulls will also be looking out for the Consumer Price Index, due to be released on November 13, for an improvement from last month’s lukewarm inflation numbers. Cooler inflation data should tilt the odds in favor of another interest rate cut in the Federal Reserve’s December meeting. Unless the bulls get a lot of help here, the bears should remain in control for the foreseeable future.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

EMA: Exponential Moving Average. A moving average that applies more weight to recent prices than earlier prices, reducing the lag of the moving average.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).

Volume Profile: An indicator that displays the total volume of buys and sells at specific price levels. The point of control (or POC) is a horizontal line on this indicator that shows us the price level at which the highest volume of transactions occurred.

This post Bitcoin Support Under Attack as Bears Look to Push Price Below $100,000 first appeared on Bitcoin Magazine and is written by Ethan Greene – Feral Analysis and Juan Galt.