Bitcoin Magazine

What Has Bitcoin Become 17 Years After Satoshi Nakamoto Published The Whitepaper?

Today marks seventeen years since Satoshi Nakamoto’s publication of the Bitcoin Whitepaper on the cryptography mailing list in 2008. Back then Bitcoin was nothing more than a proposal for a new niche technology, the latest in a long lineage of niche technologies created by the cypherpunks of the 1990s.

Bitcoin has gone through many massive transformations since that day 17 years ago. It went from a niche internet collectible, to a decentralized network powering illegal dark net markets, to a mainstream speculative investment for retail, to Wall Street and governments all over the world’s favorite new asset class. We have all had front row seats to the first explosive global technological revolution to the internet, and it’s been a wild ride.

On this anniversary I think it’s important to touch on a concept that is very relevant, POSIWID, or the Purpose Of A System Is What It Does. The basic idea is that when you have a complex system, it is pointless to try to define it based on what you want it to do, what really matters is what the pieces of that complex system are actually doing. That is all that matters at the end of the day.

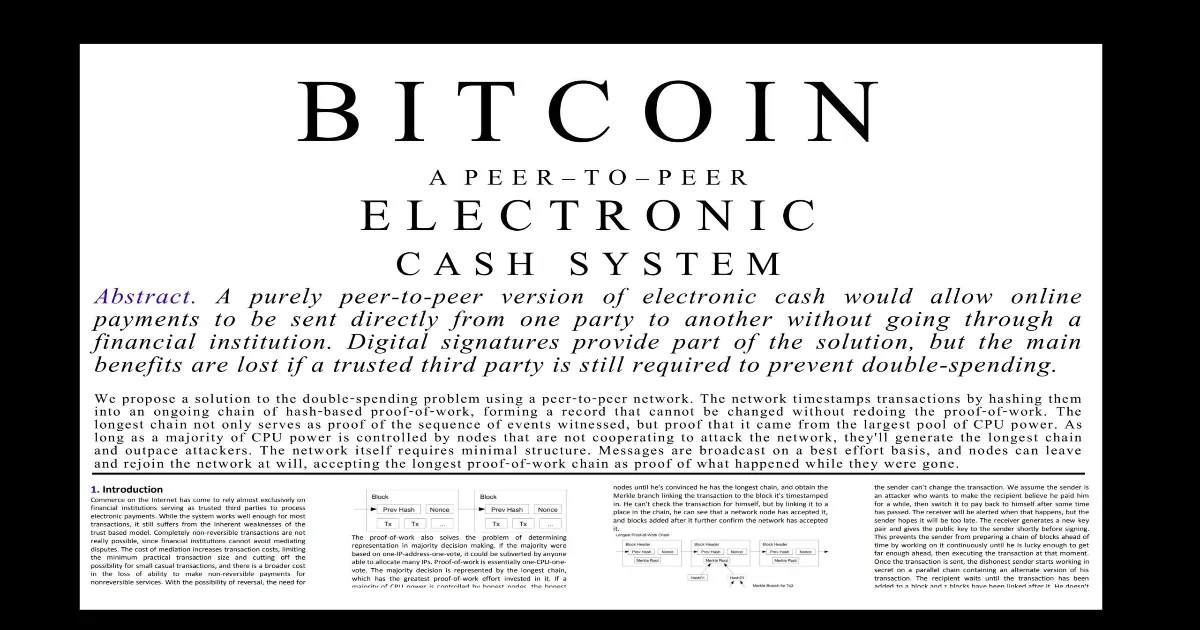

We have once again found ourselves in a time period where people are calling back to the whitepaper as a placeholder for some kind of founding document, or definition, or blueprint. The whitepaper is none of those things. It is simply a high level abstract explanation of a Proof-of-Work blockchain being used to implement a digital currency. It is the idea of a cart with wheels, versus the actual blueprint of the cart (the source code).

Bitcoiners seem to periodically fixate on the whitepaper in this manner, and inevitably use that as a justification for acting antagonistic towards some use case or idea of improving Bitcoin that they disagree with. Maybe we will eventually get past this, maybe we won’t, but it is an unhealthy attitude to have towards such a potentially impactful technology such as Bitcoin.

People didn’t recite the writings and speeches of Alexander Graham Bell when digital modems were invented to allow the first tendrils of the early internet to reach out between devices and facilitate digital signals flowing between them. They embraced it as a valuable technological innovation, and in the world today that dynamic has completely inverted itself. Most telephonic signals are now actually conveyed by communication mediums specifically constructed for digital communications.

Telephone networks were used to bootstrap the digital medium of the modern internet in a way that Alexander Graham Bell might have had only the barest inklings of, reshaping the entire world in ways that would have been impossible to conceive for people of his generation.

Satoshi did not give us a founding document to be shackled and constrained by when he released the whitepaper, he gave us a high level description of the software that followed.

That is the actual gift he gave us, the software. And he gave it to us completely freely, open-source, to do with what we decide to do.

“BitDNS users might be completely liberal about adding any large data features since relatively few domain registrars are needed, while Bitcoin users might get increasingly tyrannical about limiting the size of the chain so it’s easy for lots of users and small devices.” -Satoshi Nakamoto, 2010

This quote is always brought up in the context of the blocksize limit, or Bitcoin enabling multiple functionalities, but the thing that has always stood out the most to me is “users might get.” In the end before his disappearance, Satoshi is clearly being explicitly deferential to the wishes of users, and in the context of a critical and foundational decision like the blocksize limit.

Bitcoin isn’t Satoshi’s anymore, it’s ours, and collectively with how we actually use our bitcoin, we decide what the purpose of the system is. It’s important to remember that.

This post What Has Bitcoin Become 17 Years After Satoshi Nakamoto Published The Whitepaper? first appeared on Bitcoin Magazine and is written by Shinobi.