Bitcoin Magazine

From Stealth to Scale: Fedi Unveils Multi-Sig Guardians for Federated Bitcoin E-Cash Mints

Fedi, the Bitcoin company building on top of the open source Fedimint protocol — a privacy-centric bitcoin payments method using Chaumian e-cash — is emerging from a period of quiet development to announce a new groundbreaking feature. Set for release today, this new capability within the Fedi app aims to make the creation of multi-signature e-cash mints easy, private, and secure for communities worldwide with just a few clicks, aligning with cypherpunk principles of decentralization and user sovereignty.

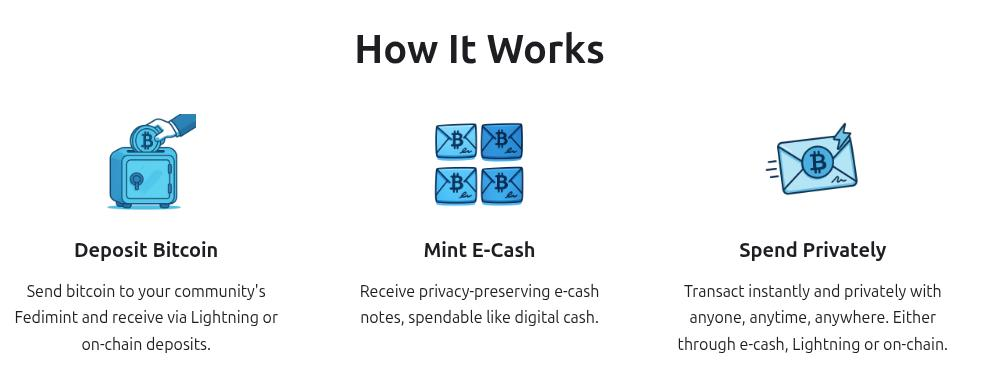

Built into their increasingly popular Android and iOS apps, the new release allows users to easily create a new Fedimint federation with the help of G-bot, a friendly chatbot interface. Mint founders need to pay a basic service fee, add some basic information in minutes for the mint, and wait a few hours.

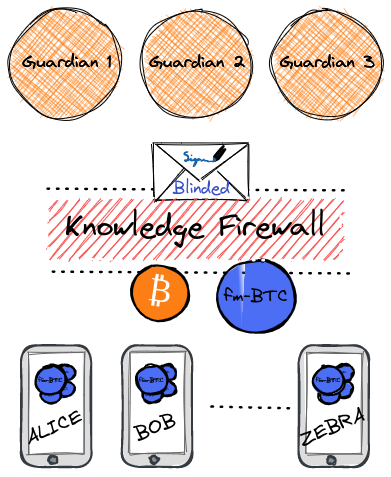

The G-bot then finds trusted anonymous Guardians to help form the user’s mint federation. This process decentralizes the custody of the mint’s bitcoin reserves — needed to operate an e-cash mint. It also helps prevent collusion as mint operators are anonymous from each other and would need to reveal themselves publicly to be able to find other key holders to collude.

This Fedimint protocol is fundamentally built on privacy, a cornerstone of Bitcoin and the cypherpunk movement. “The first line of the Cypherpunk Manifesto is that privacy is necessary for an open society in the electronic age. It’s not nice to have. It’s not convenient. It’s necessary.” Obi Nwosu, CEO of Fedi, told Bitcoin Magazine in an exclusive interview. He added a cautionary warning about the future, which the world would be wise to avoid: “Bitcoin without privacy is our worst nightmare. It’s 1984 coin, it’s the panopticoin.”

Founded in 2022, Fedi has been quietly working to deliver the promises of private digital cash to the world, based on one of the most promising technologies designed for that purpose, David Chaum’s 1982 Chaumian e-cash. This form of digital money almost made it into every copy of Windows 1995, proof of its scalability and efficiency, but ironically failed due to its centralization, as Chaum and Gates reportedly could not reach a final agreement on the deal.

Fast forward 30 years, and the Bitcoin community has taken on the challenge of bringing private digital cash to the world, leveraging new possibilities unlocked by the Bitcoin network, which may solve the fundamental trade-off of Chaumian e-cash, the need to trust a single counterparty mint that issues and redeems the e-cash bills for the underlying currency.

It is interesting to note that Bitcoin was designed as a solution to the fundamental trade-offs of e-cash. While e-cash relies on a trusted server to approve transactions that are properly funded, it can do so without knowing any personal user information, since the system is fundamentally built on cryptography and not identity. It nevertheless requires a trusted server, which can in theory emit more e-cash bills than it has reserves for, a form of the ‘double spending problem’ Satoshi Nakamoto sought to address in his Bitcoin white paper.

Centralized e-cash mints can also be more easily harassed by hostile governments, as the pre-Bitcoin history of digital cash shows. Bitcoin decentralized the mint by distributing the accounting process the mint does with the invention of the Bitcoin node, anyone that runs a node has a copy of all bitcoin transactions and can independently verify the accounting integrity of the system, thus solving the ‘double spending problem’.

The downside of Bitcoin’s approach is that it leaves a public record of all transactions, which is not great for privacy, and has hard theoretical limits in terms of how many transactions it can process per second — it is not very scalable — two limits which the e-cash systems do not have.

The downsides of centralized cryptocurrency platforms are something that Nwosu has deep professional experience with; he was the founder and CEO of Coinfloor, a centralized cryptocurrency exchange founded in 2014. The exchange was the “First ‘Publicly Auditable’ Bitcoin Exchange” according to a 2014 Coindesk, through an innovative auditing process called proof of reserves. Recalling back on his experience with the matter, Nwosu said, “Being solvent is a very big thing for me as well as being able to prove that cryptographically, if possible”. That experience and his concern over a future without private digital cash are clear motivations for why he co-founded Fedi.

Creating scalable, decentralized, private digital cash, however, is not easy, neither technically nor politically. To solve this fundamental problem of finance and computer science, many in the Bitcoin community have been looking for ways to combine the benefits of Bitcoin and Chaumian e-cash in order to solve — or at least mitigate — the downsides of both systems. The Fedimint protocol’s most important innovation in this field is the development of federated e-cash mints, leveraging the security of Bitcoin’s native smart contract capabilities, especially multi-signature transactions.

Bitcoin’s multi-signature script enables something new in finance, a transaction that can only be executed if more than one party agrees to sign. Banks may have shared accounts across multiple parties, but those are rules enforced by lawyers, who need to comply with local laws, ultimately giving final say to the local government. Bitcoin, by contrast, defends the integrity of a multi-signature with the full weight of its international proof of work network, making these agreements as good as gold and unlocking a new kind of federated financial institution. The Liquid Network, as well as Bitcoin’s Lightning Network, exists only thanks to this multi-signature technology.

Fedimint takes multi-signature to the next level, making the members unknown to each other through the G-bot, protecting users of that mint from the collusion of the guardians while also adding redundancy to the custody of mint bitcoin reserves, which makes hacks more difficult. Fedimint also protects Guardians from accidental loss of keys, as a threshold of Guardians can restore the stability of a federation, say 3 out of 4 signers, in case one loses their keys or gets compromised, on the topic Nwosu said “the bigger risk isn’t collusion but users forgetting passwords, which federations mitigate since the system continues if one guardian fails.”

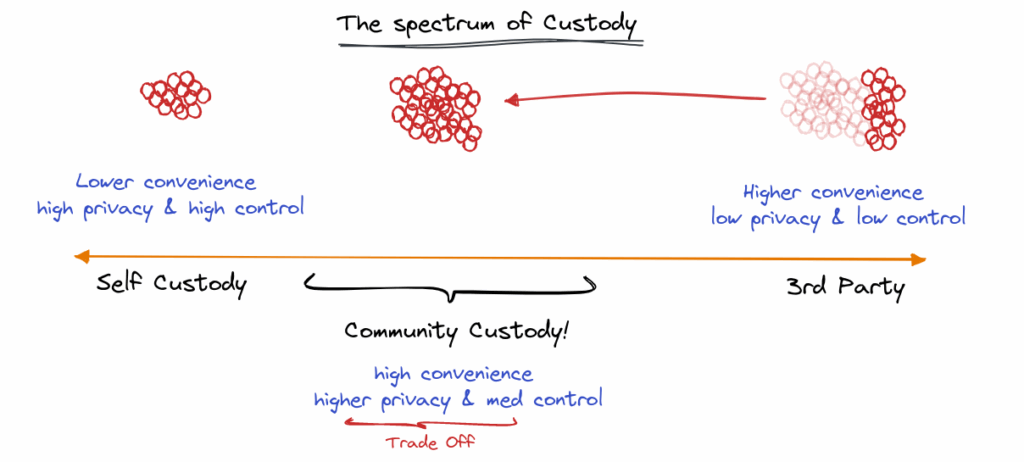

Ultimately, Nwosu expects there to be “tens of thousands, if not hundreds of thousands, of federations, each with a different set of users using it.” These mints connect to each other using the Bitcoin standard and its various payment rails such as onchain Bitcoin and the Lightning Network “offering cryptographic privacy within each federation. Even when sending between federations via Lightning, privacy remains high because users are interchangeable within pools. No single point of trust or failure.”

One common critique of e-cash systems, even post Bitcoin, is regarding self-custody. Critics argue that e-cash, even in a federated network, is nevertheless a custodial trusted system of money, and on this topic, Nwosu had a particularly powerful insight: “If you have self-custody and no privacy, you don’t have self-sovereignty because someone knows exactly what you’re doing and can confiscate your money at any point.” Because e-cash does not leave an on-chain footprint, it can be fundamentally more private than any blockchain.

This post From Stealth to Scale: Fedi Unveils Multi-Sig Guardians for Federated Bitcoin E-Cash Mints first appeared on Bitcoin Magazine and is written by Juan Galt.