Bitcoin Magazine

Bearish Bitcoin Outlook: Resistance Wall at $112K Blocks Recovery to $122K

Bitcoin Price Weekly Outlook

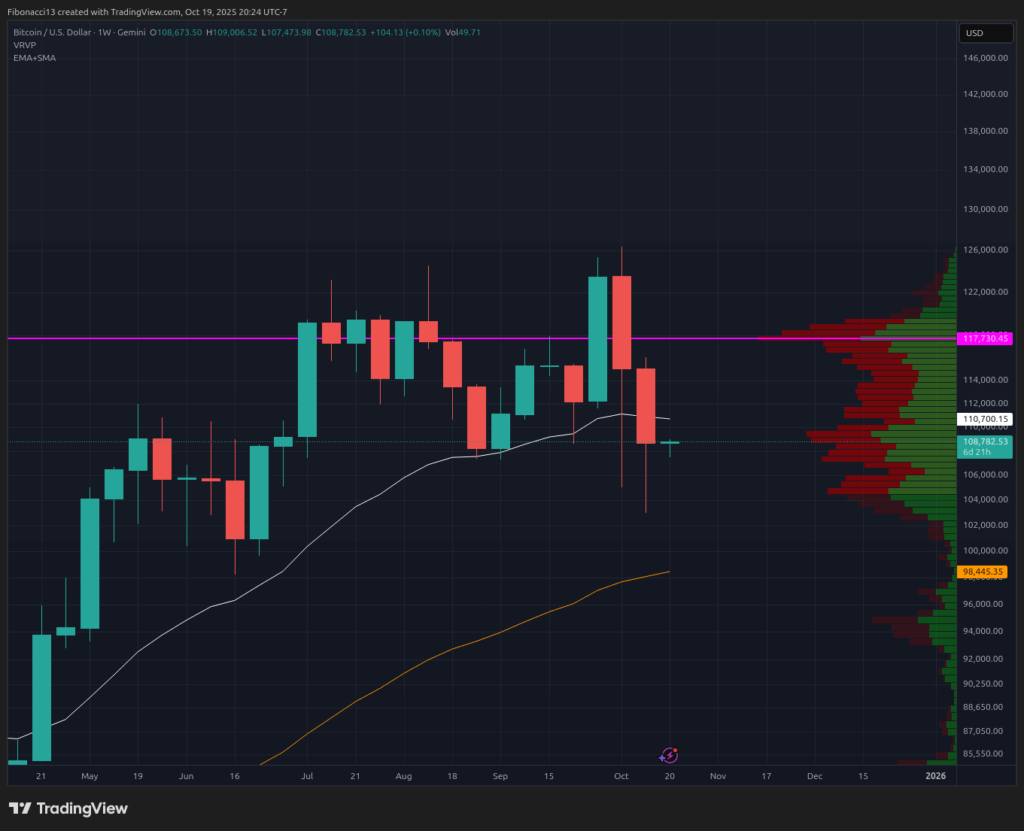

The bears came out in full force once again last week as bitcoin took out last week’s low at around $105,000 to hit $103,000 and change. We again saw a nice bounce from the support zone down there, but so far the bounce is weaker than we experienced the week prior. The bulls are back on their heels once again and looking like they will remain subdued for the foreseeable future. Last week gave us a closing price of $108,717, firmly below the 21 EMA support level we were hoping to hold, and providing further conviction to the overall bearish bias.

Key Support and Resistance Levels Now

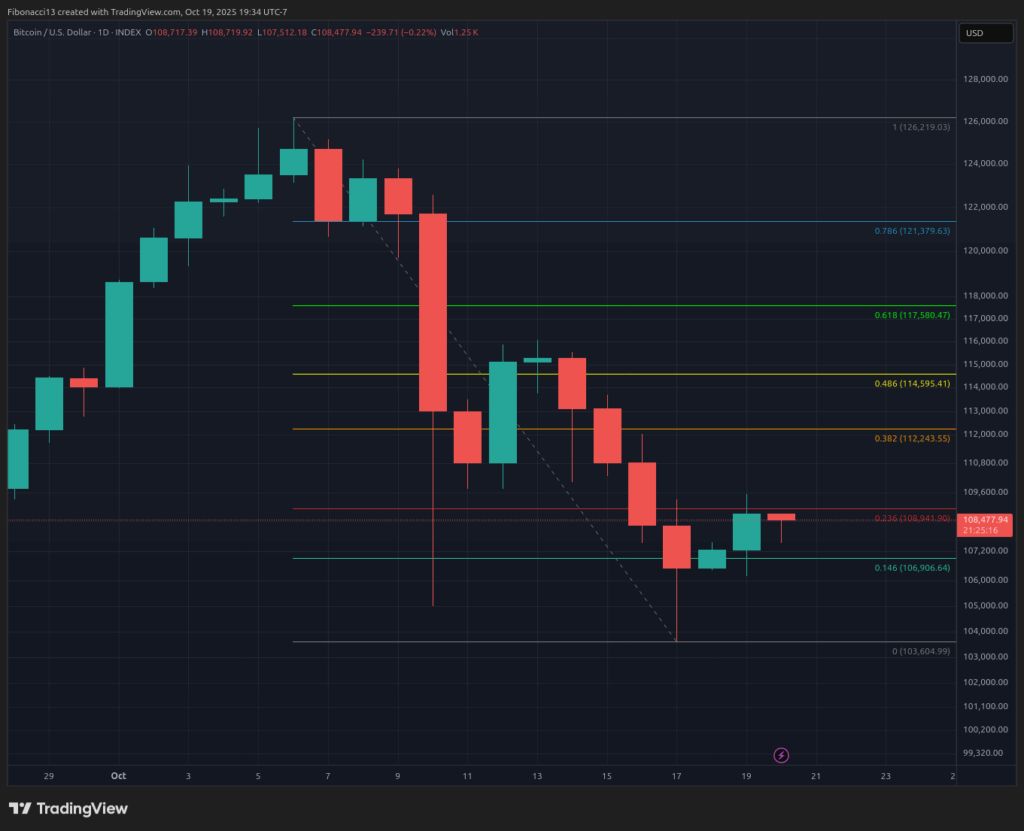

Overhead resistance is now looking extremely formidable on the chart. We have a wall of resistance above price now, with resistance levels sitting at $112,200, $115,500 and then $117,600 sitting right on the 0.618 Fibonacci Retracement. Even if price manages to climb above all of these levels, we still have to close convincingly above $122,000 in order to turn bias back towards the bulls and look for higher prices.

On the low end, we have gotten all the strength we could hope for out of the $105,000 to $102,000 support zone, so if price revisits the lows there we should expect that zone to fail. Strong support is sitting around $96,000 below there, with the 55 EMA sitting at $98,000. At this point, we should expect to see price move further downward to try to test these lower supports. Closing below $96,000 opens up a range of lower targets and essentially puts an end to the bull market.

Outlook For This Week

We are once again seeing an expected bounce back up from the Friday low into Sunday night. It will be a tall order to close a day above even the first resistance level this week at $112,200, price will likely need to test it more than once to stand a chance at breaking it. There is a little bit of “hope-ium” support at the $106,900 level, so if price rolls over and heads back down early this week, we can look for this level to hold to give the bulls some hope. However, closing a day or two below this level is a giant invitation to sub-$100,000 prices and down to $96,000 support.

Market mood: Bearish – We just completed two big red weekly candles in a row with heavy selling volume both weeks. The bears are securely in control and may just be getting started on a downtrend here.

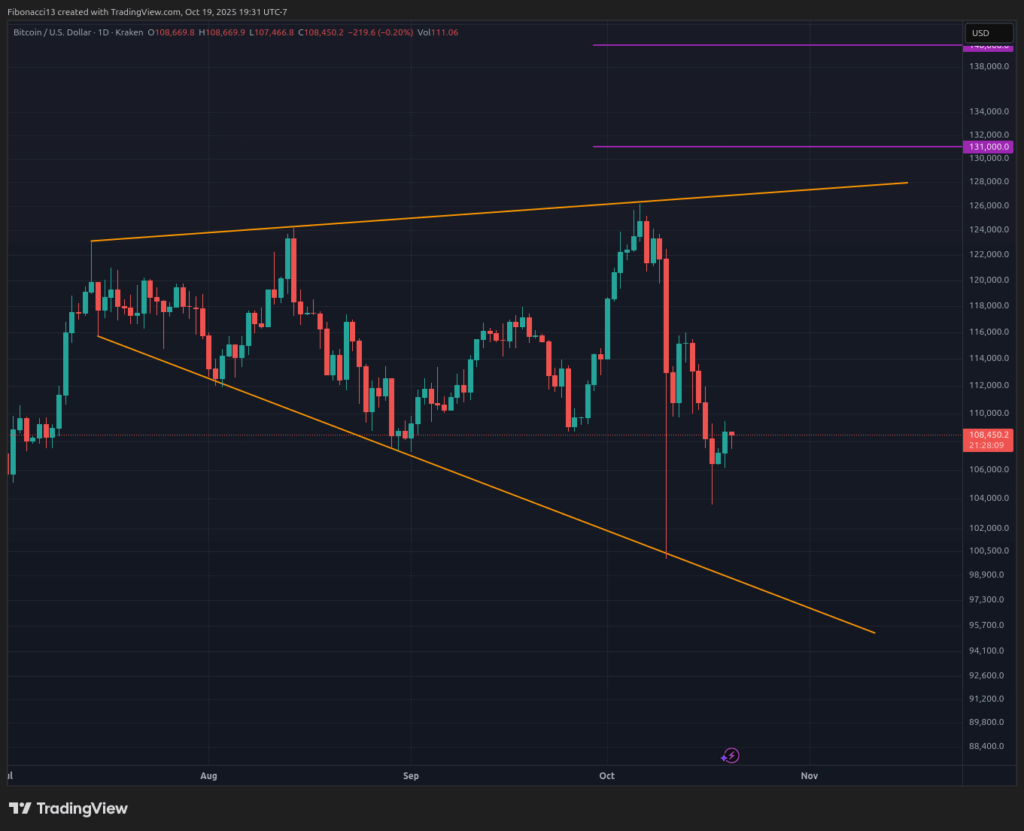

The next few weeks

On the bright side, the broadening wedge pattern has not broken down yet. Dare I say, we could even wick to $96,000 and reverse and still remain within the structure. So we cannot definitively say that the long term top is in until price breaks down out of this broadening wedge pattern. The bulls will need a lot of help to get back on track here, anything short of a 50-basis point cut on October 29th’s FOMC Meeting likely leads to more downside in the next few weeks. The bitcoin bulls will be begging Powell and his pals to throw them a bone here and give the markets a big rate cut to give them a chance to resume the long term uptrend.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

EMA: Exponential Moving Average. A moving average that applies more weight to recent prices than earlier prices, reducing the lag of the moving average.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).

Broadening Wedge: A chart pattern consisting of an upper trend line acting as resistance and a lower trend line acting as support. These trend lines must diverge away from each other in order to validate the pattern. This pattern is a result of expanding price volatility, typically resulting in higher highs and lower lows.

This post Bearish Bitcoin Outlook: Resistance Wall at $112K Blocks Recovery to $122K first appeared on Bitcoin Magazine and is written by Ethan Greene – Feral Analysis.