Bitcoin Magazine

How MSTR Could Have Gained 50K Extra Bitcoin with MVRV BTC Strategy

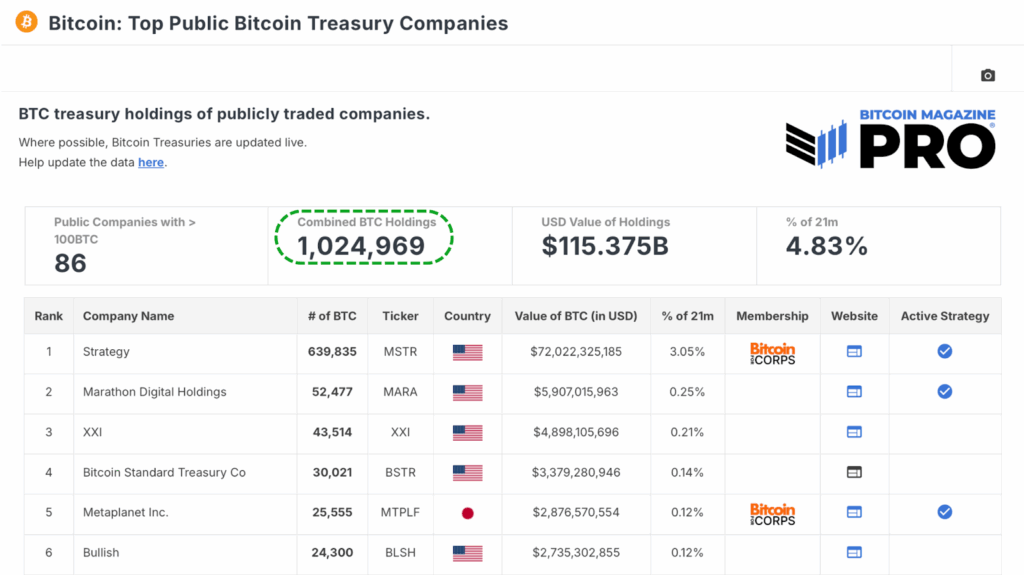

Bitcoin treasury companies have become one of the most important demand drivers in this cycle. Collectively, 86 publicly traded firms now hold more than 1 million BTC on their balance sheets. What began with MSTR (Strategy) in 2020 has since spread across the corporate landscape, with new entrants joining seemingly every week. But a closer look at their purchase history reveals a surprising insight that many of these companies could be holding considerably more Bitcoin today if they had followed a simple, rules-based strategy for accumulation.

MSTR Leads the Current State of Bitcoin Treasury Holdings

MSTR (Strategy) remains the clear leader among corporate Bitcoin holders, with almost 640,000 BTC. Across all Top Public Bitcoin Treasury Companies, over 1 million BTC is now effectively locked away, a dynamic that permanently reduces liquid supply and strengthens Bitcoin’s monetary premium (assuming, of course, they never sell!) While this has been a huge net positive for Bitcoin’s supply-demand economics, the data shows that a large share of these purchases occurred during overheated market conditions, particularly at local peaks.

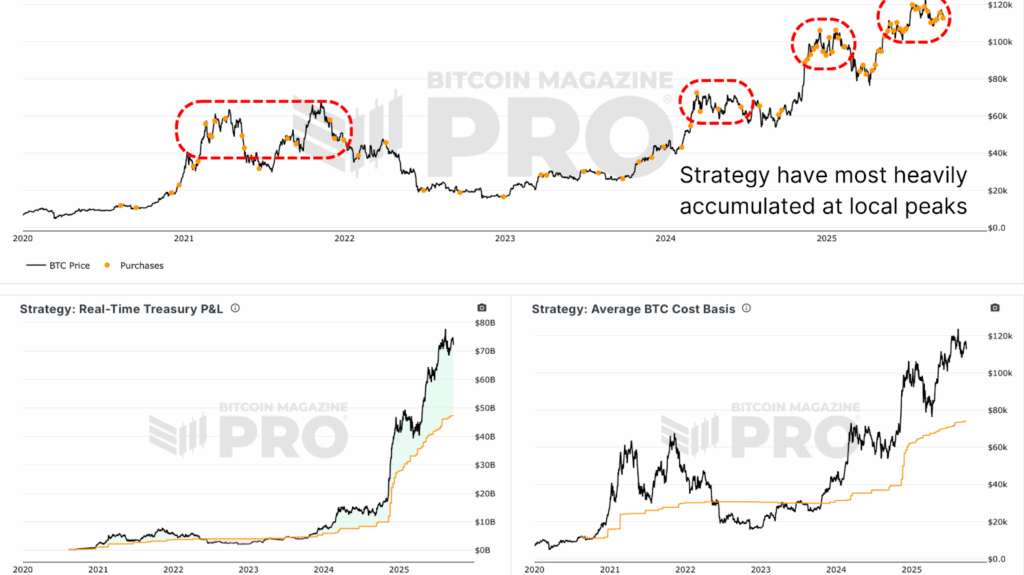

MSTR’s Example: Buying the Top in Bitcoin Cycles

Take MSTR’s (Strategy) activity as an example. The company made some of its heaviest allocations during late 2024, as Bitcoin surged above $70,000 following ETF approvals. This was far from unique, as the broader treasury sector showed the same pattern of front-loading purchases during euphoric phases.

While understandable (capital is easiest to raise when prices are rising and sentiment is high), the result is that treasury companies are often overpaying. In fact, backtesting shows that waiting for even modest pullbacks could have saved firms 10–30% on average compared to their actual entry prices. Of course, nobody has a crystal ball to predict price action, but at the very least, not buying immediately after triple-digit percentage gains in a few weeks would probably help!

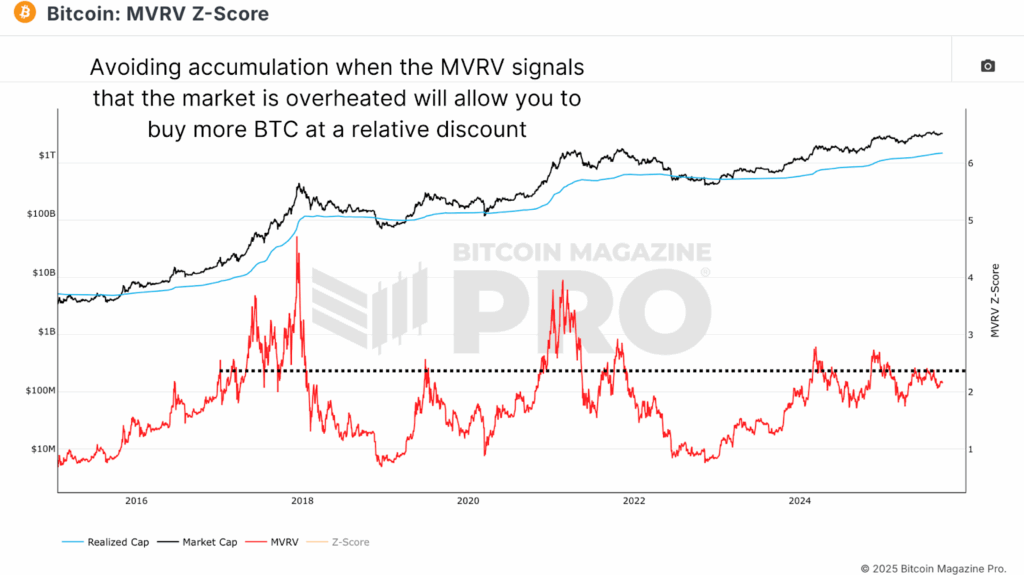

A Simple MVRV Data-Driven Fix for MSTR and Treasuries

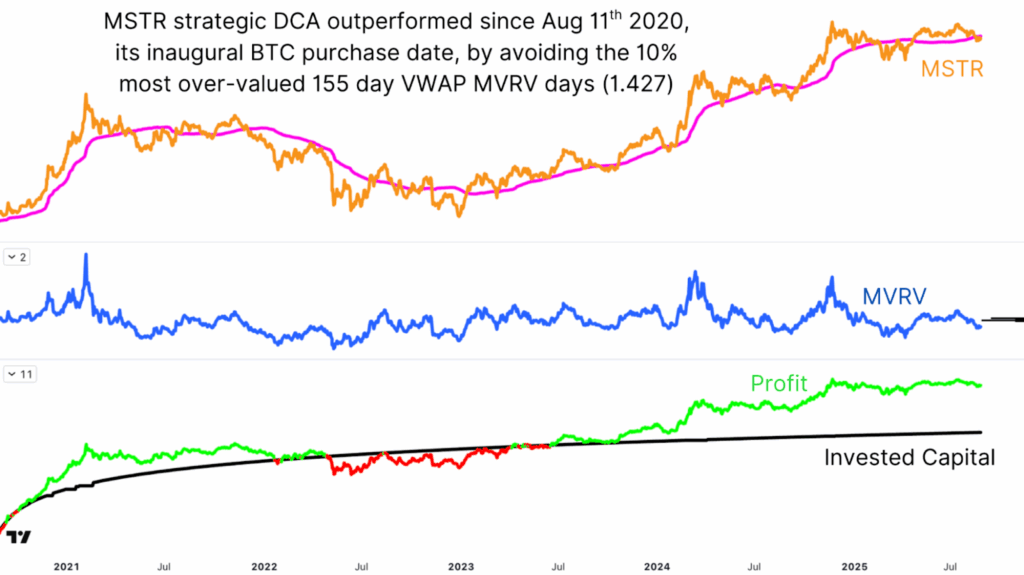

One straightforward adjustment could have made a massive difference: using the MVRV Ratio as a filter. This approach is not complex. It doesn’t attempt to time exact bottoms, nor does it rely on subjective judgment. Instead, it uses a rolling MVRV percentile threshold to avoid allocating during the most overheated phases of bull markets.

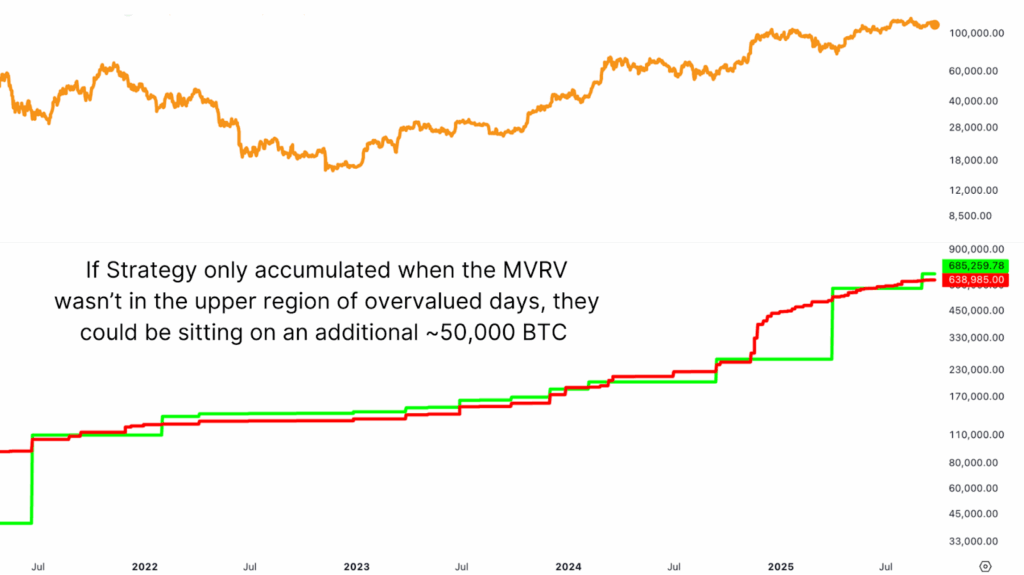

By avoiding purchases when the MVRV ratio was in its top 20% of historical readings (a proxy for overvaluation) and simply deploying that capital during cooler periods, MSTR (Strategy) alone would be holding almost 685,000 BTC today, nearly 50,000 BTC more than it currently owns.

At current prices, that’s over $5 billion in additional Bitcoin. To put that in perspective, the “missed” Bitcoin is roughly equivalent to the combined lifetime holdings of the other Active Bitcoin Treasury Companies (except Marathon Digital).

Similar frameworks have been tested on other markets such as altcoins, equities, and even the S&P 500, and they consistently outperform blind dollar-cost averaging. Strategic dollar-cost averaging beats emotional dollar-cost averaging pretty much regardless of market conditions.

Implications for MSTR, Treasuries, and Individual Investors

For treasury companies, implementing this model could mean billions in extra value over time. For individual investors, the same principle applies of simply avoiding chasing rallies during euphoric phases, and instead let the market come to you.

Of course, we must acknowledge the nuances. Corporations face constraints in raising capital, executing large block trades without slippage, and managing shareholder expectations. But even within those limits, a simple data-driven filter could materially improve outcomes.

Conclusion: MSTR’s Path to Smarter Bitcoin Accumulation

Bitcoin treasury companies have been an enormous net positive for the network. Their combined 1 million BTC holdings reduce supply, increase the money multiplier effect, and highlight the growing institutional adoption of Bitcoin. But the data shows that most of them could almost certainly be doing better. A simple strategy of avoiding purchases during overheated conditions would have netted MSTR (Strategy) alone an extra 50,000 BTC, worth more than $5 billion today.

For both corporations and individuals, the message is the same: discipline outperforms FOMO. Treasury accumulation has reshaped Bitcoin’s supply landscape, but the next evolution may be smarter accumulation strategies that maximize returns and limit the markets downside volatility without increasing risk.

For a more in-depth look into this topic, watch our most recent YouTube video here:

This Simple Bitcoin Strategy Would Have Made Them Billions

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post How MSTR Could Have Gained 50K Extra Bitcoin with MVRV BTC Strategy first appeared on Bitcoin Magazine and is written by Matt Crosby.