The New Nemesis

There is no doubt that the last cycles of elections worldwide, particularly in the U.S., have revealed several “elephants in the room” filled with hypocritic actions, psychological experiments subjecting the proletariat to new forms of manipulation, and through control under the guise of misinformation. The post-Cold War world moved from a good versus evil exposé to a world void of the enemies required to feed the West’s military-industrial-political establishment. In such a void, the illuminati in power sought a new nemesis to ensure the continuance of their power base, a foe that was easier to manipulate. The new opponent became the populus themselves.

What one may overlook is that this passage to dominate the proletariat began long before the Cold War ended. It grew from the seeds of the many self-serving efforts to improve the educational systems of the West, from the guises to protect “non-sophisticated” investors from making their own financial decisions that may tread on Wall-Street, and from the pretext to save democracy, the dollar and the market system.

The False Fiat Victory

Today, the military-industrial-political establishment claims an implicit near total victory over the 99% built on a series of skirmishes that stretch back to the 1980s, where the battles began in earnest. They were the era of deregulation, Wall-Street wolves, and the rise of financial engineering that one might alternatively call the Perestroika of money. I view the 1980s as the turning point for Western civilization. The period looked so good coming off the stagflation, economic and political decline, and war-torn and hostage-filled 1970s. However, the socio-monetary battles that ensued aimed to squash Plebians spanning from dominating their means of education, wealth creation, transport, eating and working habits and thoughts, among other areas.

If you don’t accept that the 1980s imposed such vast societal changes on us, consider that it held the birth of PEOPLExpress, the first low-cost airline where, we, the public was told that this was the future for aviation and travel with no more reserved seats or meals. The decade saw the rise of finance as the number one area of study selected by the college-age generation. Graduates were taught to forget “real” work as the future revolved only around moving money from A to B. Our food chains jumped over the cliff and continue the decline well into the 90s and beyond with innovations such as “Olestra”, the fat substitute that not only claimed to reduce your calorie intake, but offer you a side of abdominal cramping and loose stools as was printed on the warning label of all products containing it. And, for the tree-huggers reading this, the decade saw the disappearance of glass bottles replaced by the Tetra Pak plastic generation.

While I reference a glut of ground shaking actions in the 1980s, one of the most important movements was the nuisances imposed over our educational systems. These impositions gave birth to long-lasting negative consequences in the ability of individuals to have rational thought, express tolerance, and show decision-making ability. Teaching “self-esteem” in schools without earning it became the mantra. Giving a reward for just “trying” became 35% of your college syllabus grade. Recall that this California-created crusade reasoned that increasing people’s self-esteem could reduce crime, poverty, pollution, global warming, and most social evils. Yet, they never mentioned that it could “fix the money” or “fix the world”. Rather than educating the masses on practicality and rationality, the masses are taught to just pat themselves on the back. This change in mentality, this revision to the social and educational orders in the 1980s, I postulate, were the triggers to the downfall of global societal norms and values and subsequently financial literacy.

“The losers are the true winners”

Over the subsequent decades, the movements I highlight have imposed damage to the ensuing generations impacted financial literacy among other societal norms. We now see the results of these, perhaps, well-intentioned, yet misguided programs resulting in the frustration we have, as we try to educate not only youth, but grown adults about Bitcoin.

I recall a phrase I heard on a TV sitcom once that will go unnamed for risk of a copyright transgression: “The losers are the true winners.”

Is this the current world we want?

Sorry for my rant but as Shakespeare said: “I rant, therefore I am”. If you’re depressed at this point in my tirade, either take a pill, a nap or grow a pair….or some other fruit and plod forward.

“Rotten” Orange…..Pilling

What is wrong with investors and markets today? They are the TikTok investor generation who decide that they can make investment decisions and quick money after spending 14-hours a day scrolling the app as a replacement to the mediocre quality of university “education” in practical finance. Today’s investors think they are immune to the past. They know it all. Somehow knowledge learned from history no longer matters beyond their 5-years of work experience at a Big-4 consulting firm after obtaining a dual business/fourth-century art history degree paid from $200,000 of student loans.

The Wall-Street-political-media industrial complex added to investor “dumifiction”. They did this through tribulations like the manipulation of Libor, gold market collusion, and the Madoff Ponzi that gave birth to pure mistrust of all established financial or mathematical impetus regardless of its foundation or its potential source of learning. Politically motivated misinformation further fed the fire advocating that inflation is “good for you” and recessions don’t exist as previously known. Global political powers also added their bits telling you to be “green or die”.

“A fool and his money are soon parted” was the adage. Yet, today, the fool earns at the expense of the rational.

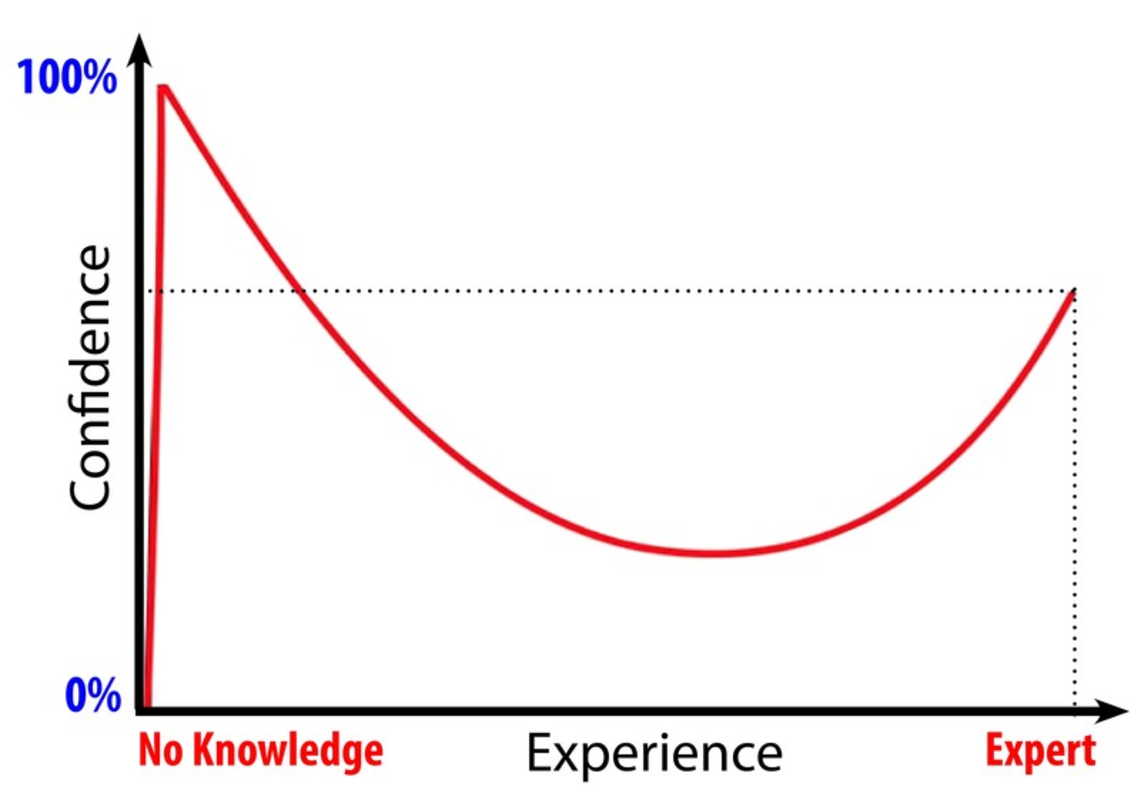

To this ratatouille of the miss-guided and ill-informed current investor generation, global central bank money printing presses since the 1980s added their drug through the creation of a glut of liquidity. Arm the TikTok investor with liquidity and in the words of Alan Greenspan “irrational exuberance” results. Investors believe falsely that they are experts in portfolio theory, risk management, and investing. The liquidity glut has run rampant through the TikTok generation faster than a Fauci/Gates inspired virus.

In other words, these Rotten Oranges over the last decades have created today’s irrational money management mentality. The Dunning–Kruger effect has incentivized throwing money at “Shitcoins” rather than Bitcoins.

Moneyzine.com reported that the percentage of US adults with poor financial literacy stood at 25% in 2023, that Gen Z and Gen Y have the lowest financial literacy rates among US generations, at 38% and 45% respectively, and that 48% of teens say they learn about personal finance on social media.

Aleksandr Solzhenitsyn said that: “Human beings are born with different capacities. If they are free, they are not equal. And if they are equal, they are not free.”

But can a value proposition, a monetary revolution overcome such a dilemma?

Would Aleksandr Solzhenitsyn ever have hypothesized that his words could be applied to our desire to break free of Fiat hegemony?

Can Bitcoin offer human beings a great equalizer and personal freedom at the same time?

From Rotten Oranges to Orange Blossoms

Educating the new generation not only on Bitcoin but also re-educating the masses on financial common sense needs to be a priority. Practicality must again prevail versus likes earned on Instagram. The Robinhood’s of today need to stop learning finance on TikTok and study historical context. Regarding Bitcoin the intrepid Greg Foss said it’s “just math”.

The “soft spoken” Max Keiser also said: “We must continue to educate the masses and encourage savings in Bitcoin to truly drain the kleptocratic swamp ruling our financial system.”

Even “God’s Banker” could not escape being the wrath of the non-common-sensical Fiat world with his demise under just one bridge too far.

Without financial common sense as written by Benjamin Franklin in “The Way to Wealth“,

“We are taxed twice as much by our idleness, three times as much by our pride, and four times as much by our folly”

Are you ready to re-awaken to the needed reality or be taxed four times?

This is a guest post by Enza Coin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.