Buying Bitcoin at significantly higher prices than just a few months ago can be daunting. However, with the right strategies, you can buy Bitcoin during dips with a favorable risk-to-reward ratio while riding the bull market.

Confirming Bull Market Conditions

Before accumulating, ensure you’re still in a bull market. The MVRV Z-score helps identify overheated or undervalued conditions by analyzing the deviation between market value and realized value.

Avoid Buying when the Z-score reaches high values, such as above 6.00, which would indicate the market is overextended and nearing a potential bearish reversal. If the Z-score is below this, dips likely represent opportunities, especially if other indicators align. Don’t accumulate aggressively during a bear market. Focus instead on finding the macro bottom.

Short-Term Holders

This chart reflects the average cost basis of new market participants, offering a glimpse into the Short-Term Holder activity. Historically, during bull cycles, whenever the price rebounds off the Short-Term Holder Realized Price line (or slightly dips below), it has presented excellent opportunities for accumulation.

Gauging Market Sentiment

Though simple, the Fear and Greed Index provides valuable insight into market emotions. Scores of 25 or below often signify extreme fear, which often accompanies irrational sell-offs. These moments offer favorable risk-to-reward conditions.

Spotting Market Overreaction

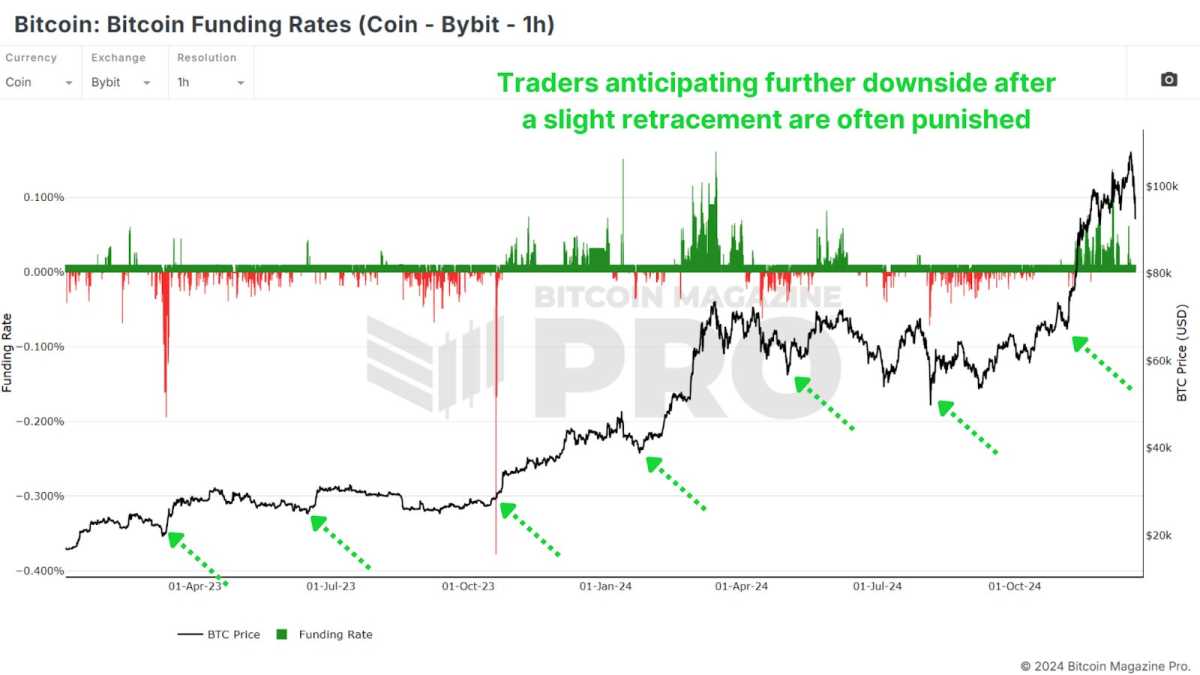

Funding Rates reflect trader sentiment in futures markets. Negative Funding during bull cycles are particularly telling. Exchanges like Bybit, which attract retail investors, show that negative Rates are a strong signal for accumulation during dips.

When traders use BTC as collateral, negative rates often indicate excellent buying opportunities, as those shorting with Bitcoin tend to be more cautious and deliberate. This is why I prefer focusing on Coin-Denominated Funding Rates as opposed to regular USD Rates.

Active Address Sentiment Indicator

This tool measures the divergence between Bitcoin’s price and network activity, when we see a divergence in the Active Address Sentiment Indicator (AASI) it indicates that there’s overly bearish price action given how strong the underlying network usage is.

My preferred method of utilization is to wait until the 28-day percentage price change dips beneath the lower standard deviation band of the 28-day percentage change in active addresses and crosses back above. This buy signal confirms network strength and often signals a reversal.

Conclusion

Accumulating during bull market dips involves managing risk rather than chasing bottoms. Buying slightly higher but in oversold conditions reduces the likelihood of experiencing a 20%-40% drawdown compared to purchasing during a sharp rally.

Confirm we’re still in a bull market and dips are for buying, then identify favorable buying zones using multiple metrics for confluence, such as Short-Term Holder Realized Price, Fear & Greed Index, Funding Rates, and AASI. Prioritize small, incremental purchases (dollar-cost averaging) over going all-in and focus on risk-to-reward ratios rather than absolute dollar amounts.

By combining these strategies, you can make informed decisions and capitalize on the unique opportunities presented by bull market dips. For a more in-depth look into this topic, check out a recent YouTube video here: How To Accumulate Bitcoin Bull Market Dips

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.