The Lightning Network is a revolutionary scaling solution for Bitcoin, enabling fast and inexpensive payments that make everyday transactions with Bitcoin possible. As the network grows, it’s essential to measure its health and efficiency accurately, so we can unlock its full potential.

Traditional metrics like node count, channel count, and capacity have been used to assess the Lightning Network, but they only tell part of the story. To truly understand the performance of this second-layer solution, we need to focus on flow—specifically, Max Flow, a metric with a long history of optimizing complex systems.

Max Flow: The Key to Understanding Lightning’s Health

Max Flow is a powerful metric that calculates how much value can theoretically flow through a network, considering constraints like channel capacity and liquidity. It’s an essential tool for evaluating network effectiveness and reliability, particularly in systems where smooth, uninterrupted flow is the key to success.

Max Flow has been used for decades in industries ranging from telecommunications to logistics. It’s already been applied to solve problems in:

- Telecom Networks: Max Flow helps allocate bandwidth efficiently, ensuring that data flows seamlessly across the internet.

- Supply Chains: Companies use Max Flow algorithms to optimize the movement of goods across their global distribution networks, reducing delays and maximizing efficiency.

- Transportation Systems: Cities apply Max Flow to traffic management, ensuring that vehicles move smoothly across road networks by optimizing flow through intersections.

These examples showcase how Max Flow improves efficiency in complex systems where resources need to move quickly and efficiently. Now, it’s being applied to the Lightning Network as seen in new data science research from René Pickhardt about feasible lightning payments. Applying Max Flow to the Lightning Network will help ensure that Bitcoin can flow smoothly between users, even as the network scales.

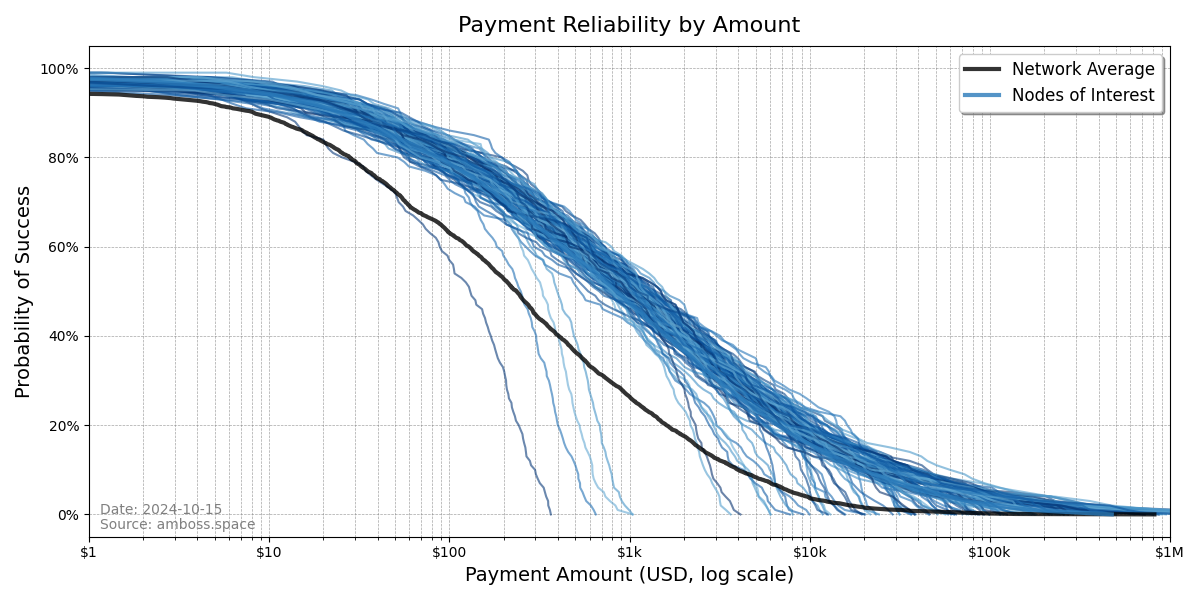

Max Flow isn’t about measuring the actual movement of value, but rather about understanding the probability of feasible payments across the network. By focusing on Max Flow, we gain a more accurate understanding of the Lightning Network’s true health. Instead of just counting channels or capacity, Max Flow shows us the likelihood of payment success, allowing node operators to optimize their liquidity and improve the overall performance of the network.

Traditional Metrics Fall Short

Metrics like node count, channel count, and capacity provide a snapshot of the Lightning Network’s infrastructure. But much like counting the number of roads or intersections in a city, these numbers don’t tell us how well traffic is flowing. In the case of the Lightning Network, what really matters is how efficiently Bitcoin can be routed through the system.

Critics who focus solely on these traditional metrics often draw limited conclusions about the network’s performance. While it’s important to know the size of the infrastructure, it’s far more valuable to understand the probability of successful payments.

Max Flow offers that deeper insight. By measuring the success probability of payments, it helps us see where liquidity is well-distributed and where bottlenecks might be forming. This enables operators to make data-driven decisions that improve the network’s performance and ensure that payments are routed reliably.

Max Flow Shows Lightning’s Performance Rises with Bitcoin Price

The Lightning Network is designed to scale with Bitcoin, offering fast and cheap transactions without overloading the Bitcoin blockchain. As Bitcoin’s price appreciates, the network’s capacity to handle larger payments grows naturally.

For example, if a channel holds 0.1 BTC and Bitcoin is priced at $50,000, that channel can route a $5,000 payment. If Bitcoin’s price doubles to $100,000, that same channel can handle $10,000—without any changes to the underlying infrastructure. As the bitcoin digital economy grows, so too will the capabilities of the Lightning Network. Bitcoin price increases coupled with data-driven changes to the Lightning Network will help expand the capabilities of Lightning.

Max Flow plays a critical role here, helping to measure the success probability of payments as the network scales. It provides an essential tool for monitoring payment reliability and ensuring that the network remains efficient as demand for Bitcoin transactions grows.

Max Flow is the Future of Lightning Monitoring

Max Flow is the next-generation metric that will help drive the Lightning Network forward. By moving beyond superficial statistics like capacity or node count, it offers node operators and investors a more accurate picture of the network’s performance. This, in turn, helps them make smarter decisions about liquidity allocation and payment routing.

For investors, Max Flow offers a more reliable measure of network health, revealing the underlying potential of the Lightning Network. Those who focus on Max Flow will gain deeper insights into the scalability and efficiency of Lightning, positioning themselves to capitalize on future growth.

For node operators, understanding Max Flow means being able to optimize their channels for better performance. It helps them manage liquidity more effectively, ensuring that payments flow reliably, and improving the user experience for those interacting with the network.

Conclusion: Max Flow is the Metric That Matters

As the Lightning Network evolves, Max Flow will be essential to its health and performance. While traditional metrics like node count and channel capacity offer a limited view of the network, Max Flow reveals how efficiently value can move through the system—a critical insight as Bitcoin grows and the demand for reliable payments increases.

Max Flow is more than just a new way to measure the network—it’s the key to unlocking the Lightning Network’s full potential. By focusing on the metrics that matter, node operators and investors can help the network scale smarter, ensuring that Bitcoin’s role in the global economy continues to expand.

TL;DR

- Traditional metrics like node count, channel count, and capacity don’t provide a full picture of the Lightning Network’s performance.

- Max Flow is the right metric to assess network health, as it evaluates the probability of feasible payments and liquidity optimization.

- As Bitcoin’s price appreciates, the Lightning Network’s capacity to handle larger payments grows naturally, and Max Flow helps monitor this process.

- Max Flow has proven its value in optimizing complex networks in industries like telecommunications, supply chains, and transportation.

- Max Flow will play a critical role in helping the Lightning Network scale efficiently, making it an essential tool for both investors and node operators.

This is a guest post by Jesse Shrader. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

About Amboss:

Amboss is building the infrastructure for the Bitcoin Lightning Network, enabling seamless, real-time transactions across industries. With machine-learning-powered routing and liquidity optimization, Amboss ensures billions of low-cost payments happen securely and efficiently. As AI-driven economies emerge, Amboss provides the backbone for autonomous systems to transact at scale.