The Loyalty Business on the Fiat Standard

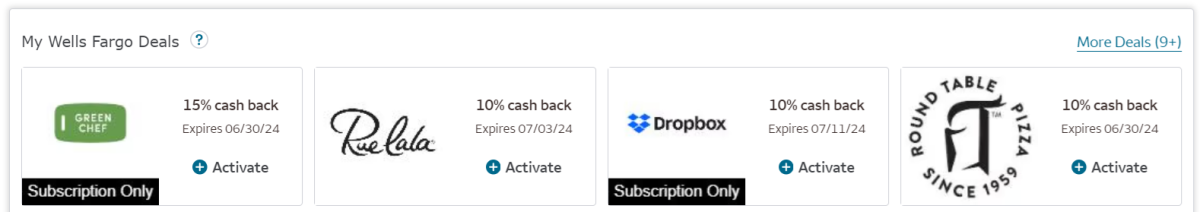

I worked at Mastercard for the last ten years, in the San Francisco office, building card-linked offer solutions to drive merchant loyalty. It’s a fascinating business, where cardholders receive merchant offers delivered via their bank, providing them with a discount if they make a qualifying spend at participating merchants. Below is an example of a sample of these offers/deals from my personal Wells Fargo bank account.

The offers drive new customer acquisition, reactivate lapsed customers and drive higher spend frequency and ‘basket size’ from existing customers. Overall, the marketing solution is very effective at driving incremental spend behavior, mainly through credit card (some debit card) payment channels.

Enter Bitcoin

Bitcoin as medium-of-exchange doesn’t get much attention, as bitcoiners are supposed to Hodl their bitcoin and there is understandable anxiety about incurring taxable events from spending, but setting these concerns aside for a minute, let’s examine the business opportunity for driving merchant loyalty on bitcoin rails instead of fiat rails. What changes? It’s no exaggeration to say that bitcoin utterly transformers the value proposition to deliver outsized economic surplus never before seen, with efficiency and use cases that fiat can never match.

Costs

The provision of any fiat merchant offers program is an expensive undertaking, requiring a significant and complex tech stack and a team of people to: credentialize participating merchants, confirm merchant contract, assign offers to cardholders subject to forecasted marketing budgets, detect qualifying spend events, reward redeeming cardholders with statement credits, compile reporting for merchants to show program efficacy, and reconcile billing. Most importantly, all of the consumer spending is driven on the most expensive payments channel (to the merchant); credit card.

Bitcoin rails drop a significant number of steps in this process. Merchants could participate in a model more akin to Google Adwords via a self-service portal credentializing via commitment of bitcoin to fund the marketing budget in real time (which can also be deprecated in real time too – never possible in fiat offer programs). The bank and card processor are no longer involved as gatekeepers in the end-to-end solution; they, and their associated costs/fees, are dropped from the value chain altogether. Most importantly, the redeeming-transactions are all now driven on low cost Lightning Network rails, stripping out not just the direct credit card fee costs (typically 3% or higher) but also the indirect costs of chargebacks and fraud.

New paradigms

Fiat rails mean that consumers who participate in their bank’s merchant offer program typically do not receive any notification at the point-of-sale that they successfully got their discount, and the discount itself doesn’t show up as a statement credit until days later. A bank can invest in a real-time-notification offer-redemption solution but it’s prohibitively expensive and complex to do so, and has to be done on a bank-by-bank basis; very few do this, and there is no universal protocol to be leveraged.

Merchant funding of the fiat offers has to happen in advance via pre-funding of a committed budget, or payment is chased down with the typical ‘30 days’ type credit agreement, supported by contractual obligations.

Bitcoin rails completely upend these legacy frameworks. Consumers can not only receive notification in real-time at the point-of-sale when they take advantage of a bitcoin-native offer, to get that visceral peace-of-mind, but they receive the discount in real time too. Not only that, but ‘split payments’ is supported by technology like LN Bits and Bolt 12, where the bitcoin-native offer provider/company can also get paid in real time at the same point-of-sale event. This essentially makes the fiat ‘billing’ step obsolete. Merchants can also change the offer values, minimum spend thresholds and most importantly the inventory of remaining offers/discounts (the marketing budget) they want to commit to, in real time; such changes are impossible via the fiat channels which requires budget commitment weeks in advance. I’m only scratching the surface of the long list of unfair advantages bitcoin brings to the table in the provision of a merchant offers program, but I’ll leave it there, for now.

Caveats

Reach: An offer program is essentially a two-sided market and it’s important to have as large an audience of consumers as possible to make merchant participation worthwhile. The bitcoiner audience, and what I call the ‘bitcoin-curious’ audience, are still relatively small segments, though growing.

Targeting: Fiat merchant offer programs have a silver bullet that is currently unavailable on bitcoin, at least directly; transaction history of the consumer. This history enables the merchant to carefully spend their marketing budget on specific consumer segments like new, lapsed and loyal groups. This is an invaluable tool to ensure highest return on advertising spend (ROAS) and also enables insightful before-vs-after test vs. control ‘incrementality’ reporting, proving spend lift of the marketing campaign that is highly convincing and useful to merchants who need to justify spending money on the offer campaigns.

That said, I’d argue that these caveats are mitigated by the potential for merchants to attract the bitcoiner segment, even broadly and in an untargeted way, as the segment is so valuable; skewing affluent, influential and maniacally loyal to bitcoiner-friendly merchants.There is a first-mover advantage for any merchant in their vertical/category to attract this invaluable segment first.

The above is an example of how bitcoin strips out costs from the legacy system, like never before, unlocking much higher margins for merchants, and delivering a more immediate, visceral and satisfying consumer experience. This long list of unfair advantages delivered by bitcoin-native merchant offers cannot be copied by any competitor operating on fiat rails. This is based on my last ten years experience working on CLO merchant loyalty programs.

Michael Saylor says to “Buy bitcoin, and wait”. For many of us bitcoiners, we have the opportunity to not just ‘wait’ but to proactively help drive hyperbitcoinization. I’m taking this step with merchant offers, leveraging my expertise and experience to bring bitcoin-native offers to life. I’m curious about what dramatic cost savings and new, unique use cases other bitcoiners can uncover by reflecting on their fiat mining job experience and expertise, reimagining it through the lens of bitcoin.

This is a guest post by John McCabe. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.