On Free Speech

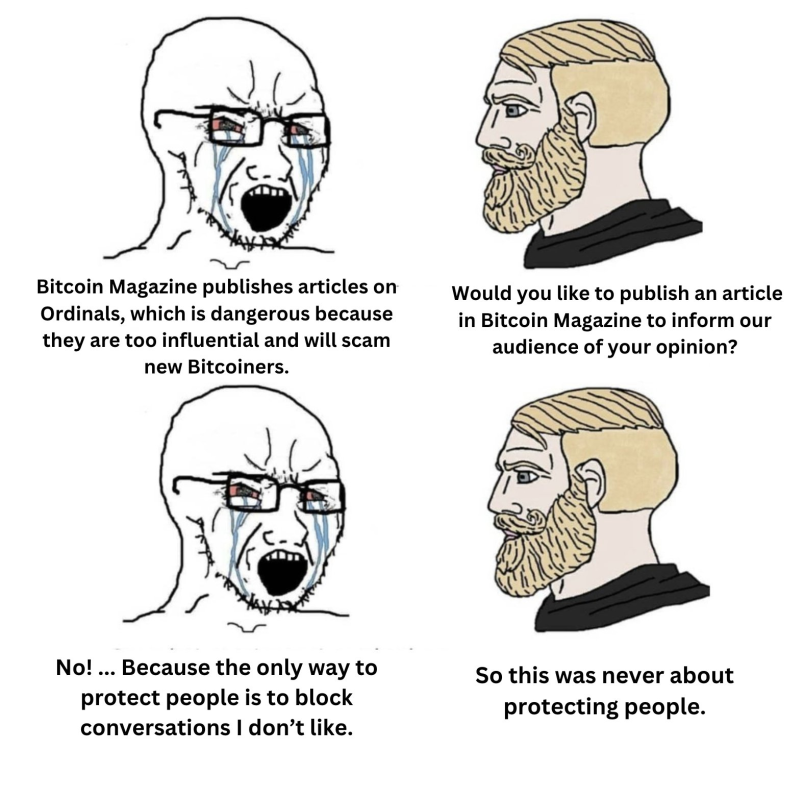

President of Bitcoin Magazine, Mike Germano, has dared me to publish this rant with the following meme:

To all the haters, yes, even in Bitcoin Magazine can free debate flourish. I’m grateful for the opportunity to submit a dissenting opinion about Ordinals. With technical editor Shinobi at the helm, writers’ contributions are permissionless!

On Technical Feats

I appreciate Bitcoin Magazine editor Pete Rizzo’s posts detailing all of Bitcoin’s history, but he is morally wrong on Ordinals, just as he was on the Ethereum Merge:

While the Merge was a great technical feat for Ethereum, the switch to Proof of Stake only made it even less decentralized. And with Casey’s technical feat of Ordinals, he also hurts Bitcoin by making it less fungible.

On Peter McCormack’s What Bitcoin Did podcast, Pete Rizzo argued that “in the worst case, people who own ordinals at least own some bitcoin.”

No. The worst case is that people realize they’ve been scammed and never want to touch Bitcoin again.

On Making Money

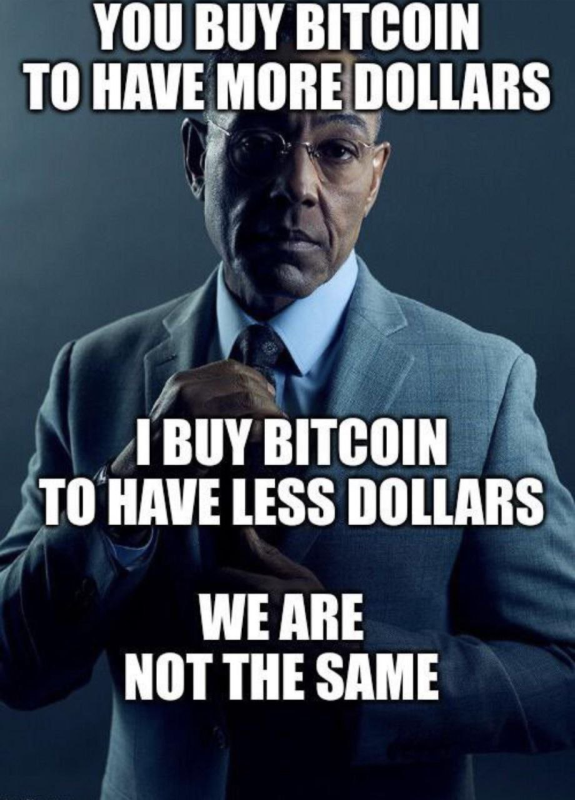

Some try to defend that flipping Ordinals for profit is not a scam, but simply people willingly gambling on speculation. Likewise, many people bought bitcoin at the cycle top in 2021 without having done any research, and haven’t touched Bitcoin since realizing losses. Speculators buy Ordinals for the same reason they buy bitcoin: to make money.

However, on this issue, the position of Bitcoin Maxis is clear:

Bitcoin is not an intangible asset that suffers from the same Greater Fool Theory as Ordinals. Two meaningful ways saving in Bitcoin contrasts with gambling on Ordinals are network effects and actual limited supply. Many copycat altcoins have been issued, but none have the network effects of the OG. Additionally, most altcoins get dropped out of the air via Proof-of-Stake, with little physical cost to greater issuance. Bitcoin is only issued via Proof-of-Work, putting real weight and staying power behind its value.

Bitcoin Maxis who are here to fix the money, know that we don’t buy Bitcoin to make money, but to fix the world.

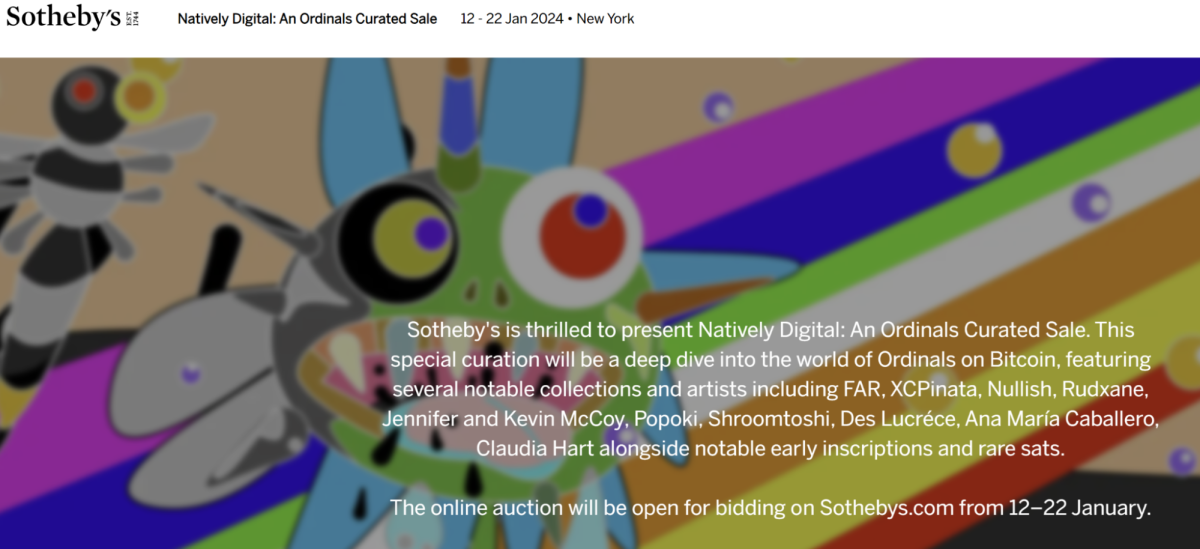

On Rare Collections

On What Bitcoin Did, McCormack makes the case that no one is buying Ordinals to actually collect. Some Ordinals supporters have deluded themselves to the point that they think while most are trying to flip, some are actually collecting. Esteemed art auction house Sotheby’s held an auction in January 2024 for ordinals, but putting their brand behind this “collection” doesn’t make it so.

I concede that whether or not I am morally opposed doesn’t change the fact that there are people who find value in collecting worthless things. Some may argue that Sotheby’s isn’t scamming anyone if they are a willing buyer for digital art. However, it is a scam because they’re not buying digital art since they don’t actually own anything. I can add the same digital art to any transaction. It’s only with their shared delusion that by using the ordinal protocol, same as their peers, the digital art they own in their transaction is more valued than the digital art in mine.

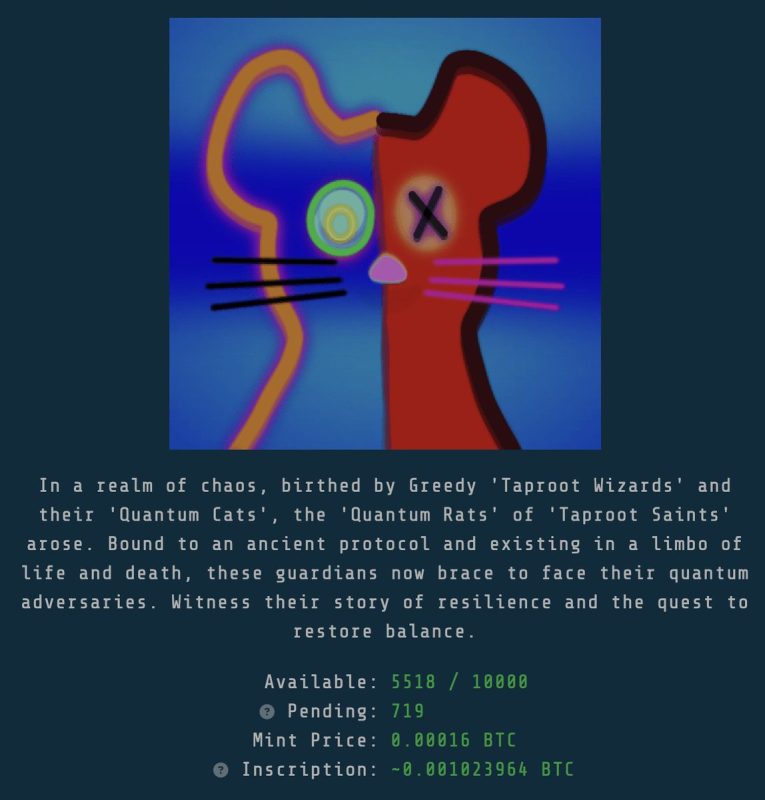

What I will NOT concede is the notion that ordinals and NFTs are unarbitrary—they are. I can take the jpeg of every Quantum Cat, and re-release the same 3000 cat collection, and tell people mine don’t cost 0.1 bitcoin each, but only 0.0001 bitcoin each. Such cheaper. Much better deal!! There’s nothing rare or special about it. Do people want to pay Udi or Sotheby’s the 0.1 bitcoin to own the address to the Sat to the cat in their collection, or the same cat in mine? In fact, a copycat collection has already been created trying to do just that, called Quantum Rats.

Of course adding other collections isn’t quite as direct as diluting supply of an existing one, but it’s close enough. If a collection starts small and gets so expensive that the creators make a separate but similar collection with the purpose of making them available for more people, it’s really just to scam more people. It’s a moral judgment, but Ordinals don’t uphold the values of a Bitcoin Maximalist. Bitcoin has a finite supply of 21 million, but there’s no limit to the number of Ordinal collections that can be created. Next, Udi might release “mutant” quantum cats, or “bored” quantum cats, which become more popular and make the originals all worthless.

That’s the scam. That’s the rug pull.

The rug pull formula is simple: Start a “rare” collection, hype it up with wash trading with yourself and influencers, then leave a sucker holding the bag.

Then do it again, and again, and again.

Bitcoin could succumb to “greater fool theory” too, but the difference is the network effect that has made Bitcoin survive unlike any other pump and dump crypto.

On Digital Art Ownership

On the contrary, owning digital art does exist — intellectual property exists. I can pay for a cover art design, so I own the art for Bitcoin Girl: Save the World. I own the files and I make the merch. If anyone tries to sell physical merchandise with digital art I own, then it’s copyright infringement.

Think about all the digital files or character art for every video game or Pixar animated movie. Digital art rights exist, they are real, and they can be used to make new movies or products.

On Filtering and Censorship

I’m not trying to filter out ordinals or censor transactions, but I think supporting ordinals is wrong. For Bitcoin to succeed, it needs to be money for enemies. However, Bitcoin Maxis should still champion for people to do their own research.

Scammers are always going to scam but I’m not going to support it. I’ll still allow it, though thankfully ordinals don’t need my permission anyways.

I’m not trying to break Bitcoin by adding filtering or censorship, but I can still be opposed.

Hodlonaut put my position on ordinals succinctly:

Thank you Bitcoin Magazine for letting me rant against ordinals!

This is a guest post by Will Schoellkopf. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.