After the Bitcoin price crash last week, on-chain data reveals a picture that points to a “top-heavy” price. Glassnode’s latest insights shed light on the current market dynamics, where a significant chunk of the BTC spot supply finds itself with a cost basis either near or surpassing the prevailing price.

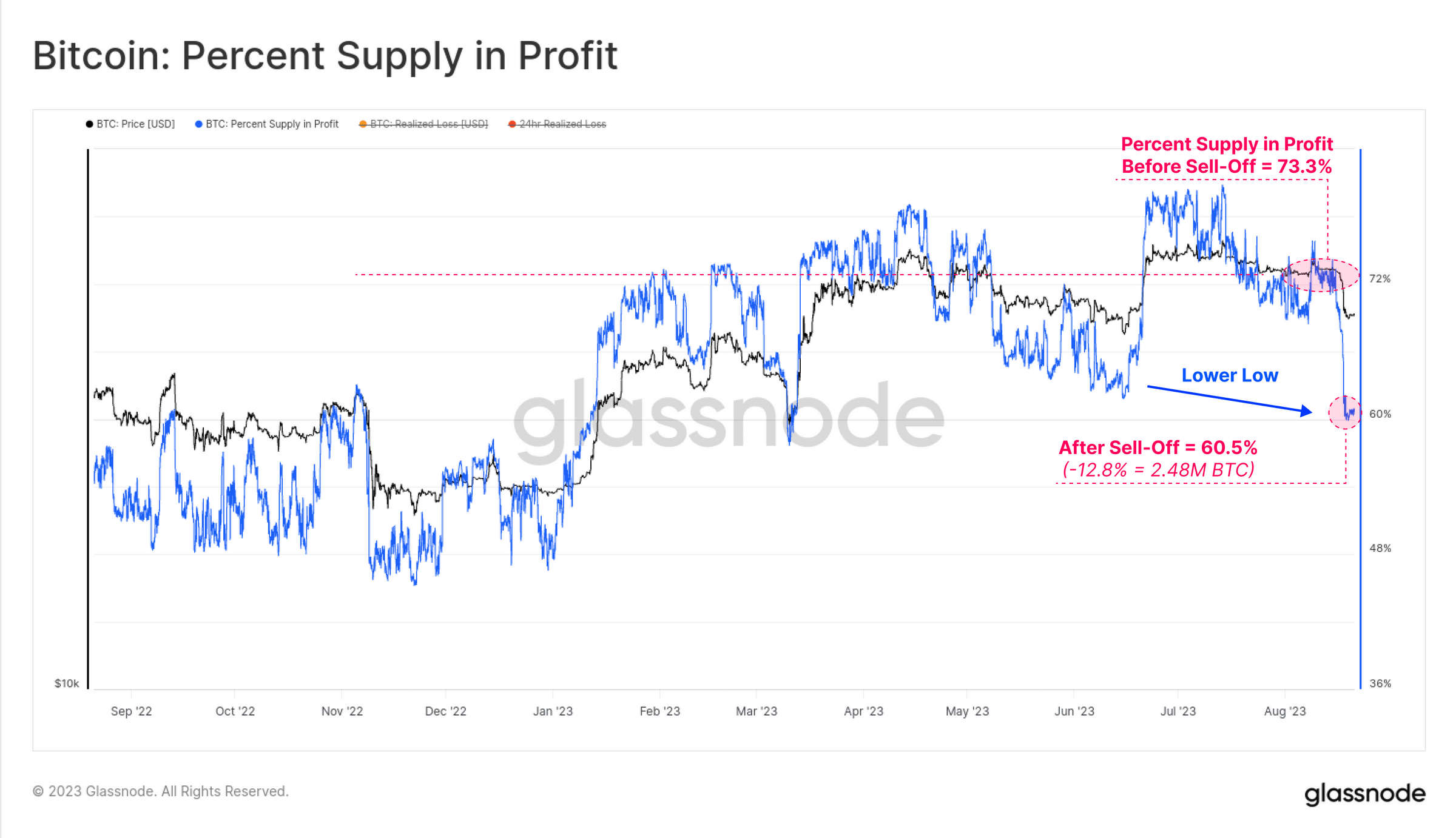

“Here we see that 12.8% (2.48M BTC) of the supply fell into an unrealized loss this week, setting a lower low on this metric. This suggests that ‘top heaviness’ in spot markets may also be a factor in play,” commented Checkmate, Glassnode’s chief analyst.

Notably, Long-Term Holders (LTHs) have displayed remarkable resilience in this turbulent period. Their interaction with exchanges remains largely unaltered, with the aggregate balance of LTHs marking a new All-Time High (ATH) this week. In stark contrast, the behavior of Short-Term Holders (STHs) emerges as particularly salient.

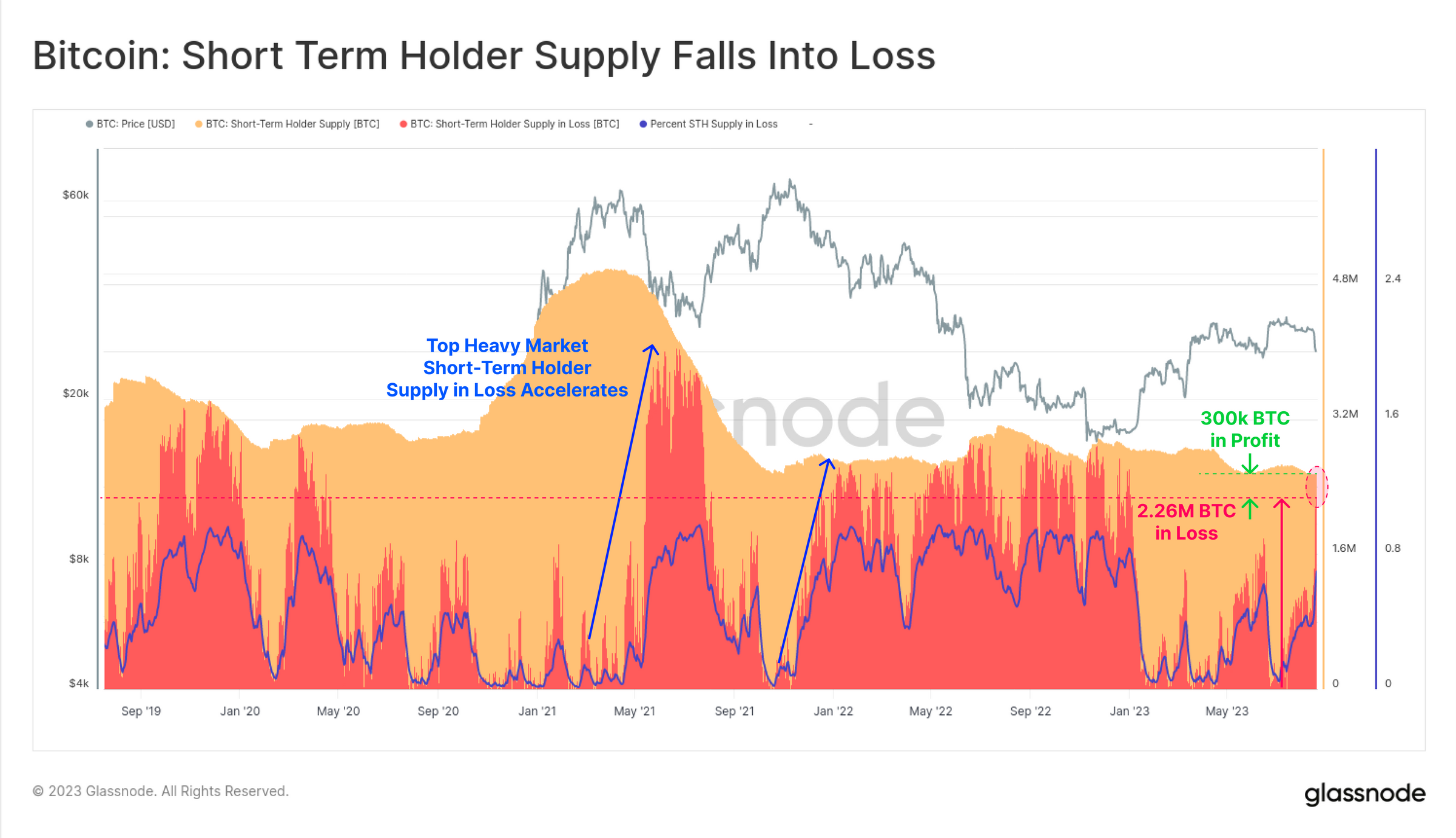

Checkmate notes, “With LTH supply at ATH, we can also see that STH supply remains at multi-year lows.” The data further underscores this: out of the 2.56M BTC held by STHs, a mere 300k BTC (11.7%) remains in profit, meaning that 88.3% are in loss. This needs to recover quickly, else it adds to the bear case, according to Checkmate.

Historical data indicates sharp upticks in STH supply losses following periods characterized as ‘top heavy markets’ – similar to the events observed in May 2021, December 2021, and once again, the last week.

Implications For Bitcoin Price

The fluctuating dynamics between profits and losses witnessed in the market can be further distilled through the Profit or Loss Bias (dominance) metric. As the 2023 rally unfolded, a discernible shift was noted in the STH cohort’s position: “This week we saw the largest loss dominance reading since the March sell-off to $19.8k. This suggests that the STH cohort are both largely underwater on their holdings, and increasingly price sensitive,” added Checkmate.

An intriguing revelation comes from Glassnode’s experimental tool aimed at discerning market inflection points. With a meticulous design that maps macro trends of investors and the prevalence of profitability over losses (and vice versa), this tool offers a nuanced ‘Momentum indicator’.

According to Checkmate, “We can see that after several months of declining profit dominance, Loss momentum and dominance have increased meaningfully.” Notably, while false positives have been recorded – as observed in the March 2023 correction – sustained declines have historically been precursors to sharper downtrends.

Overall, the Bitcoin price crash on August 17 stands as the most significant single-day decline YTD. The sell-off was primarily a futures market leverage flush out, and is thus primarily a result of short-term positioning and market structure.

However, the predominant sentiment is one of caution, largely because the most significant impact has been technical, specifically falling below long-term moving averages, a factor that could sway market sentiment.

Long-Term Holders remain stoic, but the spotlight is on the Short-Term Holders. With an overwhelming 88.3% (equivalent to 2.26M BTC) of their supply at an unrealized loss, combined with an uptick in realized losses sent to exchanges and a breach of key technical support, the onus is on the bulls to defend their stance. Checkmate concludes:

There is for sure potential for further downside momentum, but the majority of the damage is positioning and technical. The bull case is that realistically nothing has changed aside from the price, and the R/R still favors the upside. Calls for 12k are kidding themselves, but calls for 100K are as well.

Net Result == same as every pre-halving year ever.

At press time, the Bitcoin price stood at $26,084.