The tired argument that Bitcoin is a Ponzi scheme is really more applicable to fiat, which makes it impossible for us to retain savings.

This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the infantry before transitioning to the Finance Corps.

Always up, always having to add more lest you fall behind. I could feel the American dream slowly slipping away every year. We dutifully paid our bills, contributed to retirement accounts, invested prudently and yet it felt like every year things got a little tighter. A little harder to contribute what we needed to. When we found Bitcoin, it gave us hope.

“Striking is mutual suffering. A game of chicken. Bitcoin changed the game. It made striking valuable to the striker.”

–Matt Hill on “Bitcoin Audible,” episode 75

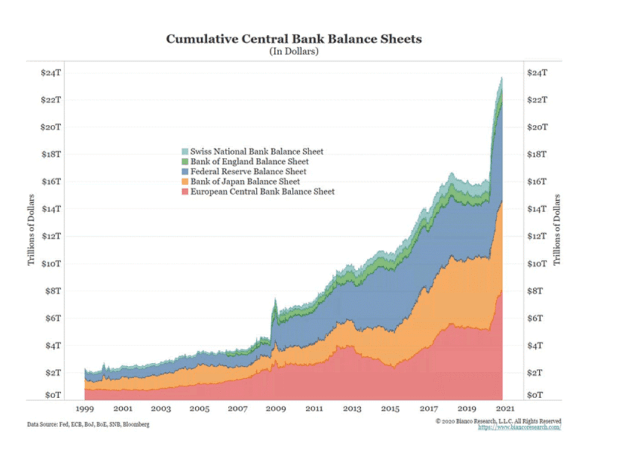

Now my wife and I are on strike, like many of you reading this article probably are. Once the money printers started roaring after the COVID-19 lockdowns began in 2020, I felt a sinking feeling that the world would never be the same again. Ungodly sums of money were thrown around on the news stations with such causal indifference. Ultimately, the results speak for themselves:

We Need Better Critics

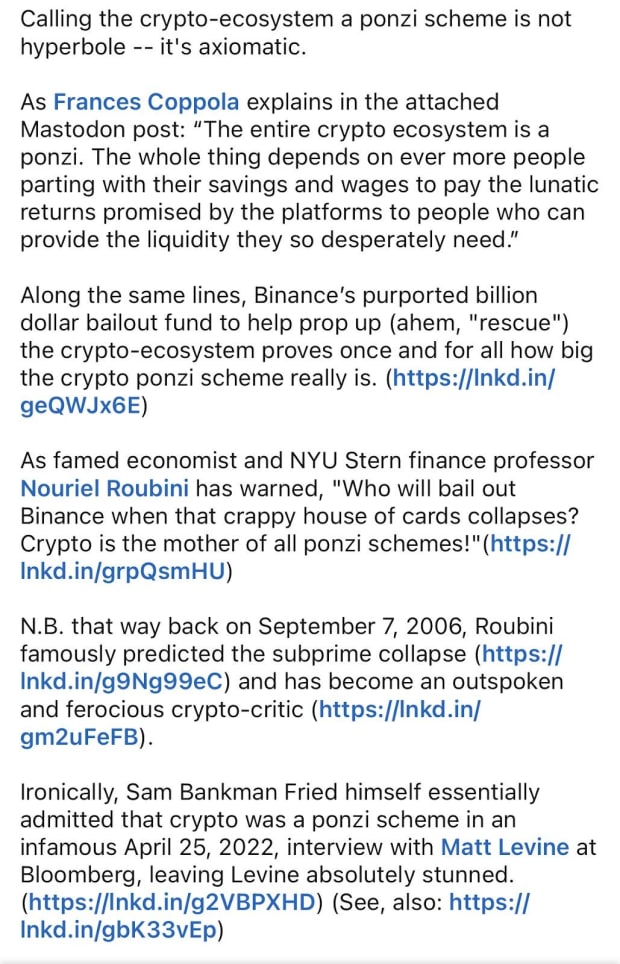

One of the most commonly-cited critiques I hear from seemingly-sophisticated investors and economic PhDs alike is that Bitcoin is a Ponzi scheme: a game of the greater fool buying from the scammy huckster as the earlier investors dump their bags on the new.

The above post beautifully illustrated the complete lack of understanding, let alone critical thinking, surrounding this particular line of FUD. The abject lack of intellectual curiosity is astonishing, yet somehow unsurprising given my recent stint in academia:

“The whole thing depends on even more people parting with their savings…”

Is this not true for the stock market? The housing market? The commodities market? By that logic, every market with fluidity of pricing based on supply and demand is a Ponzi scheme. I guess it’s time to go back to the barter economy? Or does the stock market go up on earnings alone without any buyers or demand?

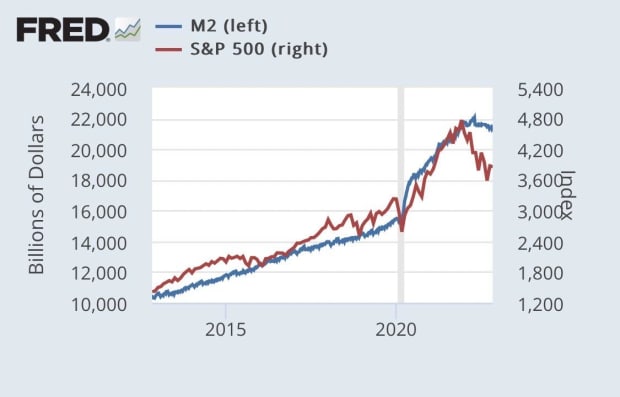

In fact, It appears to me that prices have been going up faster than earnings since about 1980, even when taking inflation into account:

The above image depicts the Shiller PE ratio for the S&P 500. It is the price-to-earnings ratio for the stock market, but adjusted for inflation. Can anyone say “Cantillon effect”?

Fiat Is The Ponzi

Crypto is a symptom, not the underlying problem. Years of pent up nihilism unleashed into get-rich-quick pump and dumps as the world seemingly falls apart around us. It’s not hard to see why. But Bitcoin is not crypto, and crypto is not Bitcoin.

In what now feels like the blink of an eye, trillions of dollars were created to prevent the system from imploding. Suddenly, the stock market was booming while it seemed like everything was crumbling. I don’t even blame the central bankers. They responded to their incentives and did what they had to, but the effects were dire. If you weren’t already invested, you lost big, making it just that much harder to get your dollars to work for you, to escape inflation and eventually escape the rat race.

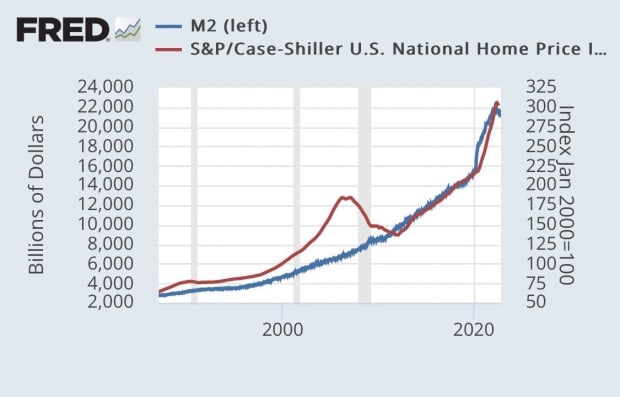

One of the most salient illustrations to me is the below graph. It demonstrates that you should buy a house, any house, it doesn’t matter. Because if you don’t already own a house, if you choose to save instead, you may never actually be able to afford one. It doesn’t take a lot of empathy to understand the financial desperation many are feeling today.

Now, I admit that I’m not a professional statistician, but the charts appear to have some significant correlation. Perhaps CPI inflation may not be the only problem. Perhaps asset price inflation may be forcing savers to become part-time investors. Supply and demand has a price impact on bitcoin, yes, but does the stock market not require new money to support prices as well?

Bitcoin Is Savings

Savings: Money put by the excess of income over expenditures.

So, why can’t we just save money anymore? The FRED graphs included here tell it all. If you don’t become an investor, you will never keep up. That is, until now.

Bitcoin is our savings in a world bereft of things worthy of investment. Even if it hits $1 million tomorrow, we’re not selling. What would we even sell it for? To diversify? Into what? A stock market completely dependent upon money printing? An investment property where our tenants won’t have to pay rent following the stroke of a politician’s pen? A shiny rock with “intrinsic value”?

You see, how could Bitcoin be a Ponzi when Bitcoiners don’t even want your dollars? What you don’t understand is that we’re playing a different game now. What you don’t understand is that we’re trying to build something new; a better future for our children and grandchildren.

So, if you think bitcoin is doomed to crash and burn then short it. Try to profit off our demise, though I don’t think you will.

We will just keep buying and holding, continuing to front-run you and Wall Street, and everyone else who refuses to even try to understand Bitcoin. We hold no anger or resentment toward you. We don’t want to eat the rich, or to burn the system down; we just don’t want to play by your rules anymore. And if we go down with the ship, at least we lost it all fighting for something we believed in.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.