Silk Road showed people that bitcoin could be effectively used as a medium of exchange on an open marketplace.

This is an opinion editorial by Jacob Kozhipatt, a YouTuber and writer.

For the uninitiated, The Silk Road was a darknet marketplace where users bought and sold all manner of products, including those considered illegal — most often drugs.

Supporters argued that the Silk Road leveraged technology to create markets necessarily divorced from the corruption of governments and big banks. For critics, the marketplace was an enemy of The State, that facilitated the sale of illegal substances that decimated countless lives.

For Bitcoiners, however, the marketplace was the first example of bitcoin being used as an actual currency — a mixed legacy as the website popularized the alternative currency, but also created a stigma surrounding digital currencies that lasts even today. So what exactly was Silk Road, and why did it play such an important role for bitcoin?

What Was The Silk Road?

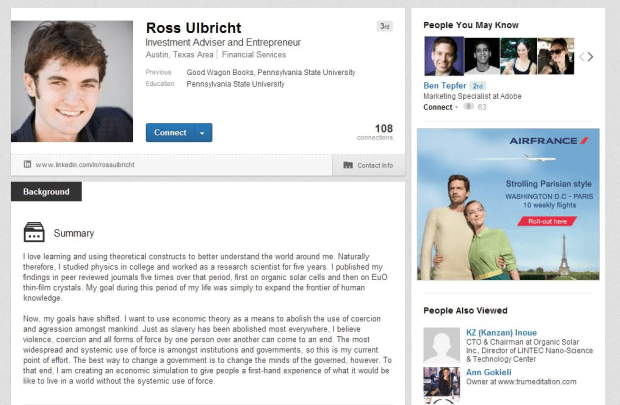

The Silk Road was created and run by Ross Ulbricht. He created the marketplace in 2011 as a manifestation of his libertarian philosophy, rooted in the ideas of Austrian economists like Ludwig von Mises. Ulbricht believed that governments inherently utilize force to impede an individual's sovereignty — a sentiment he believed manifested in the United States’ War on Drugs.

Ulbricht believed the American War on Drugs cost American taxpayers billions of dollars and was a greater instigator of violence than drugs themselves.

Ulbricht alluded to Silk Road and his motivation for creating it on his Linkedin profile, writing he sought to create an economic simulation that would show the governed first hand how to live in a world without, what he describes as, “the use of excessive force.”

It is important to note that the Silk Road explicitly forbade the sale of products or services, “who's purpose is to harm or defraud,” e.g., child pornography, weapons grade plutonium or stolen credit cards. The U.S. government, though, reported that hacking services were available on the website.

An intriguing aspect of Silk Road was the professionalism it took in presenting its illicit substances/services. While the drug trade is notorious for violence and the selling of fake drugs, the Silk Road let dealers sell their products through the mail and let buyers know if the product they bought was coming from a legitimate seller, as the Silk Road employed a seller review system akin to other e-commerce sites like Ebay or Amazon. While some were fans of this, others like New York Senator Chuck Shumer, were outraged at the seemingly causal nature of buying drugs through the platform.

In October of 2013, Silk Road was shut down. At this time, the website had over 100,000 users and had thousands of transactions, amounting to tens of millions of dollars exchanged, every day. Ross Ulbricht was soon convicted of seven crimes and received a life sentence in prison, without the option for parole.

Bitcoin And The Silk Road

Central to Silk Road was the concept of buyers and sellers hiding their identities. Two technologies served as the marketplace’s agents of anonymity: the software Tor, and the cryptocurrency bitcoin.

Users would utilize a Tor browser to access the dark web, where their IP addresses, amongst other digital locators, would be hidden from third-party surveillance.

While hiding one’s digital address was important, it didn’t solve the problem of transacting anonymously. One’s identity could still be discovered through mainstream centralized payment processors, like Visa and Mastercard, who both work with the government to identify users engaged with illegal activities. This is where bitcoin played an important role.

At this time, bitcoin was still a nascent technology with few knowing the forensic accountability that the blockchain provides. Thus, bitcoin served as a means of exchange on Silk Road. Tens-of-thousands of users would exchange millions of dollars in bitcoin to purchase items on Silk Road.

When Silk Road was shut down, 70,000 bitcoin (now worth: $1.3 billion) was seized from the website. A Vocative report detailed the volume of sales of drugs that had occurred on Silk Road: Marijuana transactions totaled more than $46 million on Silk Road, while heroin sales were worth about $8.9 million; cocaine amounted to $17.4 million.

Impact Of The Silk Road

The story of Silk Road has lasting effects on bitcoin and the greater cryptocurrency landscape.

Silk Road was the first example of bitcoin’s ability to be used as an actual currency — a true financial facilitator of exchange between individual parties. Silk Road collected revenues of roughly 9.5 million bitcoin since 2011, a jaw-dropping amount as only 11.75 million bitcoin existed at the time. In other terms, 80% of all bitcoin in existence went through Silk Road at the time it was shut down. Within two hours of the news of Ulbricht’s arrest becoming public, the price of bitcoin tumbled from $140 to $110.

To this day, Silk Road is often used as an argument by cryptocurrency critics to show that bitcoin is primarily used as a facilitator of crime. This is best demonstrated through New York’s steep regulations, specifically the BitLicense, which was set in place in 2014, shortly after the conviction of Ulbricht. Senator Schumer specifically called out Bitcoin for its use on Silk Road stating: “[Bitcoin is] An online form of money laundering used to disguise the source of money, and to disguise who’s both selling and buying the drug.” This reputation has proven to be a lasting one, as Duke professor and former Federal Reserve regulator Lee Reiners as recently as 2021 argued that bitcoin and other cryptocurrencies should be banned for their use in facilitating crime.

Obviously, bitcoin bulls, like Tim Draper, vehemently disagree with this perspective. They argue that bitcoin’s immutable ledger actually makes it easier for the government to track criminal activity done via bitcoin. For example, the $4.5 billion hackers of Bitfinex, Ilya Lichtenstein and Heather Morgan, aka the “crocodile of Wall Street,” were outed to government officials while trying to launder their stolen bitcoin because of their blockchain transaction history. Moreover, many new cryptocurrencies market themselves anonymous alternatives to bitcoin, arguing the first cryptocurrency’s privacy components are insufficient.

Many bitcoin believers view Ross as a hero for the movement and actively campaign for his release in a movement called “Free Ross,” run by Ulbricht’s mother, Lyn. Lyn Ulbricht mentions that the national perspective on drugs has changed since the conviction of Ulbricht. Marijuana, the most popular drug sold on Silk Road, is more normalized in modern Western society. U.S. President Joe Biden recently announced that all federal marijuana convictions would be overturned by the government, and urged legislatures to reconsider the federal perspective towards marijuana.

It is often people on the fringes of a society that first adopt new ideas and technologies. Many of the early 2000’s YouTube content creators, like Jeffrey Starr or Lucas Cruikshank, were members of the LGBTQ community. In Chinua Achebe’s famed novel, “Things Fall Apart,” the first members of the Igbo Tribe to convert to the then-novel idea of Christianity were the disaffected misanthropes of the tribe. Similarly, the first people to popularize bitcoin were — for better or worse — drug dealers and users who inarguably are on the fringe of our society.

This is a guest post by Jacob Kozhipatt. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.