When the United States has a significant amount of debt, high interest rates and a budget deficit, there can be no hope of ever paying it off.

This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the infantry before transitioning to the Finance Corps.

I love listening to Greg Foss on podcasts, especially when I’m gearing up for a heavy dead lift or something like that. His no-nonsense talks about bonds just really gets my blood flowing and my mind focused. But when I send stuff like that to my less finance-minded buddies, they often have trouble understanding what he’s talking about.

Here’s my attempt at some potentially oversimplified math to explain the debt spiral.

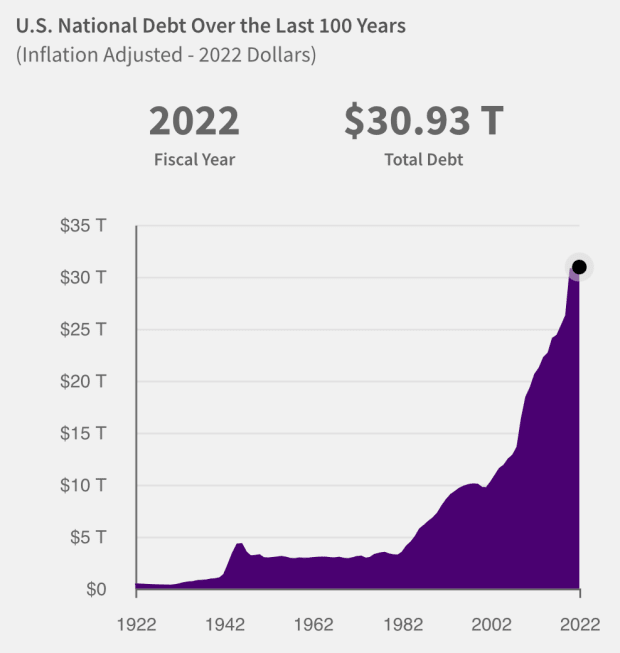

U.S. Federal Debt

As of October 13, 2022, the United States has $31,144,952,729,330.20 worth of outstanding debt. This is updated daily by the Treasury. To make the math a little more simple, let’s just call it $30 trillion. After all, what’s another trillion, give or take?

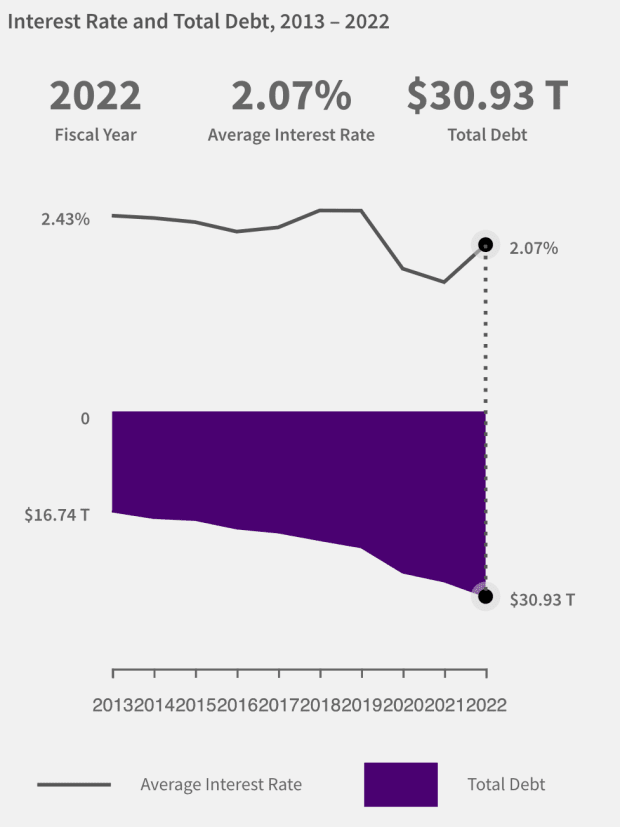

This implies a $621 billion annual interest payment on the debt this year. The Washington Post estimates $580 billion. Let’s split the difference and call it $600 billion.

If you’ve been paying attention, the Federal Reserve is aggressively raising interest rates and the market is equally aggressive in bidding up yield on government debt.. Every basis point that is added to the average rate on U.S. government debt will add about $3 billion in additional interest expense. That’s if the debt stays at its current level.

That unfortunately is not going to happen. Currently, the annual budget shortfall sits at $946 billion per year with no signs of ever going to zero. Since this is the case, not only will the U.S. government have to issue more debt at a rate of nearly $1 trillion more per year, it will be doing so while interest rates are going up fast.

The higher interest rates go, the more interest on the debt will be required to be paid. The more interest on the debt required to be paid, the larger the deficit gets. The larger the deficit gets, the more debt must be issued. More debt issued, more interest on debt. Even if the Fed dropped rates back to zero, the debt would continue to grow at a compounding rate because of the nature of the deficit.

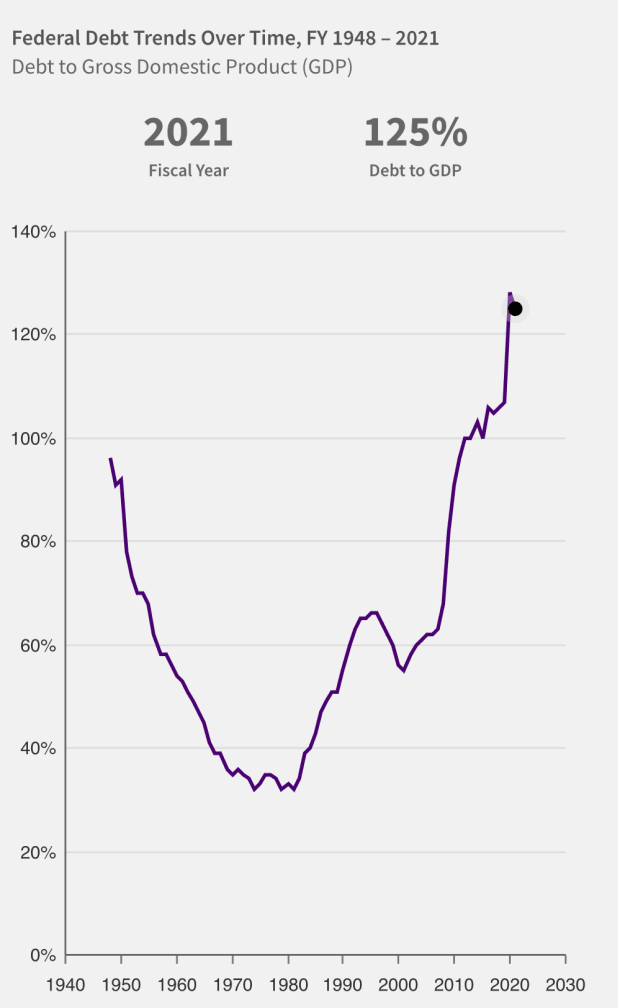

Even more concerning is the above graph depicting the debt as a percentage of gross domestic product. The upward slope of the line since the mid-1980s implies that the debt has been growing faster than the economy for decades.

The nature of the perpetual budget deficit ensures that this situation is an inevitability; the Fed is just accelerating it at the moment. Debt begets more debt as long as the deficit exists.

Hopefully you get it now. This is what Greg Foss means by a debt spiral. The debt never actually gets paid off; it just keeps getting rolled over, growing at a compounding rate. On this trajectory, it will start to accelerate.

Bitcoin Is Protection

Based on math alone, the Federal Reserve cannot continue to raise rates for much longer, nor keep them this high because the interest on the debt will become completely unmanable. There is a lot to be said about a Fed Pivot and when they will decide to taper their taper to lower interest rates back down. When will they actually do it? I’m not sure, but the Fed will have to eventually drop rates back down to try and slow the bleeding. And when it does, the rally that the bitcoin price will have is going to melt your face off.

While I am not particularly interested in the price anymore — unlike some — I am concerned with everyday people being able to hop on the bitcoin life raft before it shoots off into space.

Absolute scarcity is an absolute imperative in a world bereft of monetary scarcity. Be a good friend: help people grasp this concept, because most don’t understand what’s coming.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.